Note: Updated April 15, 2024

As lawmakers debate tax credits, cuts, and subsidies, we often hear Maine’s tax policy compared with other states. State-by-state rankings and “listicles” are memorable and get a lot of attention, but are they really telling you what you need to know to craft fair tax policy? Our tax policy experts offer some advice…

Tax rankings don’t measure what matters most to working families

- Tax rankings don’t drive a state’s economic growth, working families do. And working families and their employers are attracted to states that prioritize the services and infrastructure they rely on and which taxes pay for. Maine’s population growth rate ranks among the fastest in the nation and is the only state growing younger.

- Tax rankings created by for-profit entities are click bait. WalletHub is a personal finance website that makes its money through advertising revenue and paid listings. State and city rankings generate a high click rate, generating profit in the process. Such rankings are oversimplified and misinterpreted because they don’t give a full picture of what’s going on in the state.

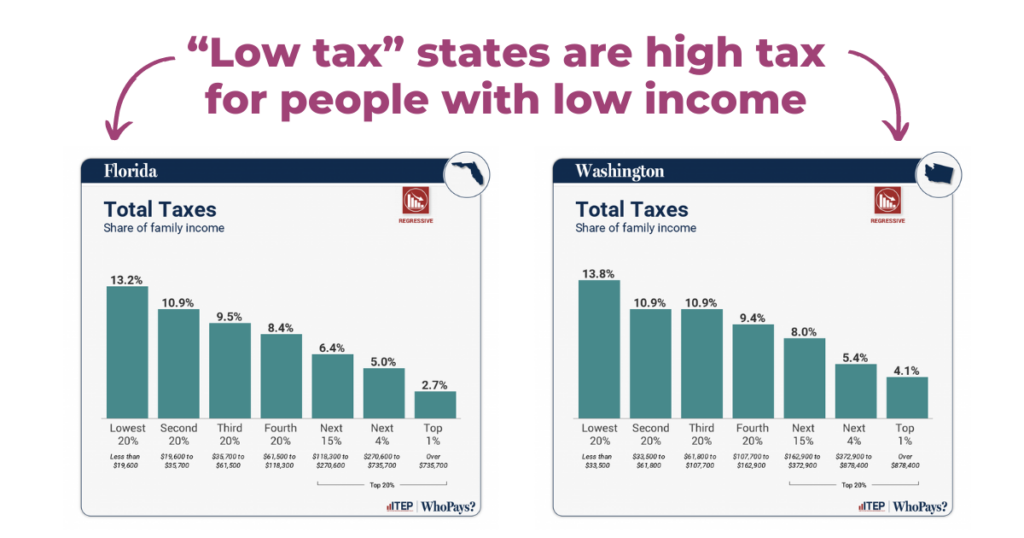

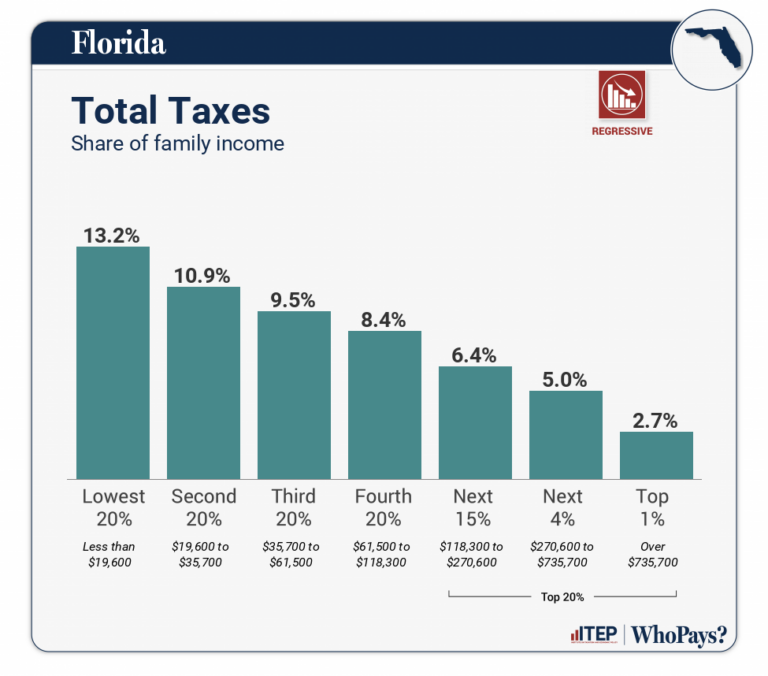

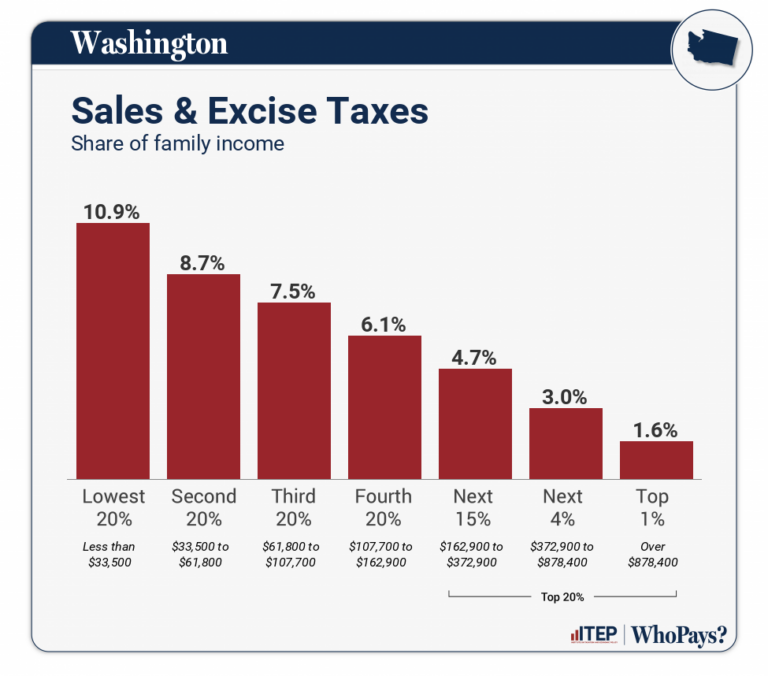

- Tax rankings vary widely and don’t always reflect how fair a state’s tax system is. For example, Florida is ranked by the Tax Policy Center as having the second lowest state and local taxes in the nation but is also shown by the Institute on Taxation and Economic Policy (ITEP) as having the nation’s most unfair tax system. And while the Tax Policy Center ranks Maine as having the fifth highest state and local taxes, ITEP’s analysis shows our tax system to be the seventh most equitable. What does that mean? It means that in “low tax” Florida, the ultra-wealthy don’t pay their fair share, while those with the least have to pick up their slack.

When it comes to taxes, fairness matters most

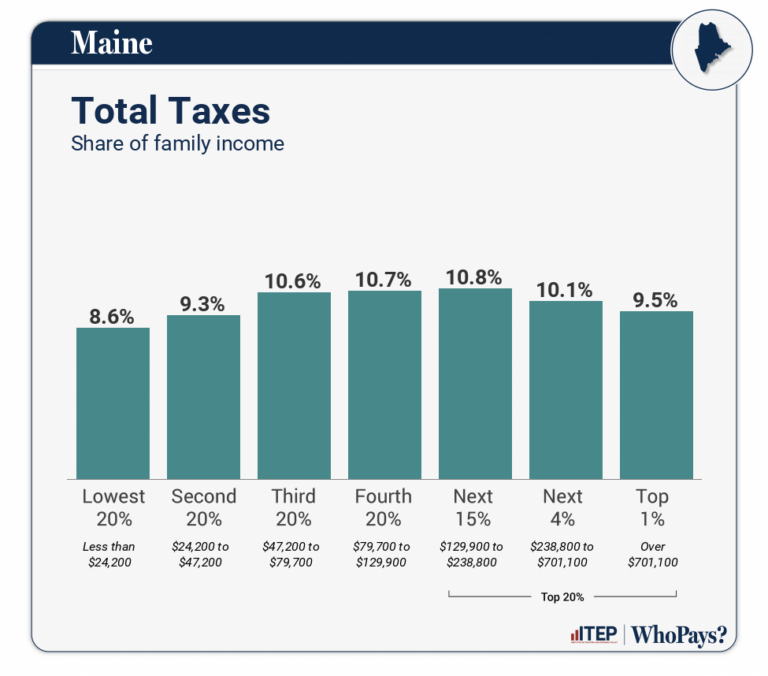

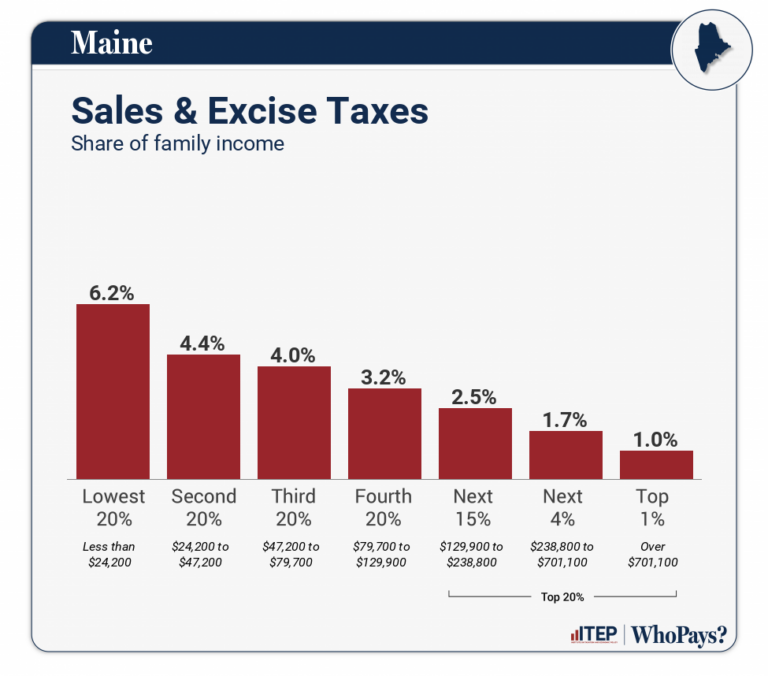

- Many “low tax” states are actually high tax for people with low income. Washington State has no income tax, but families with low income effectively pay 13.8 percent of their income in other taxes — one of the highest rates in the nation. Much of that high rate comes from sales taxes that disproportionately tax families with lower incomes. Washington families with low income pay a portion of their income in sales taxes that is seven times higher than the wealthiest families, and almost twice as much as their counterparts in Maine.

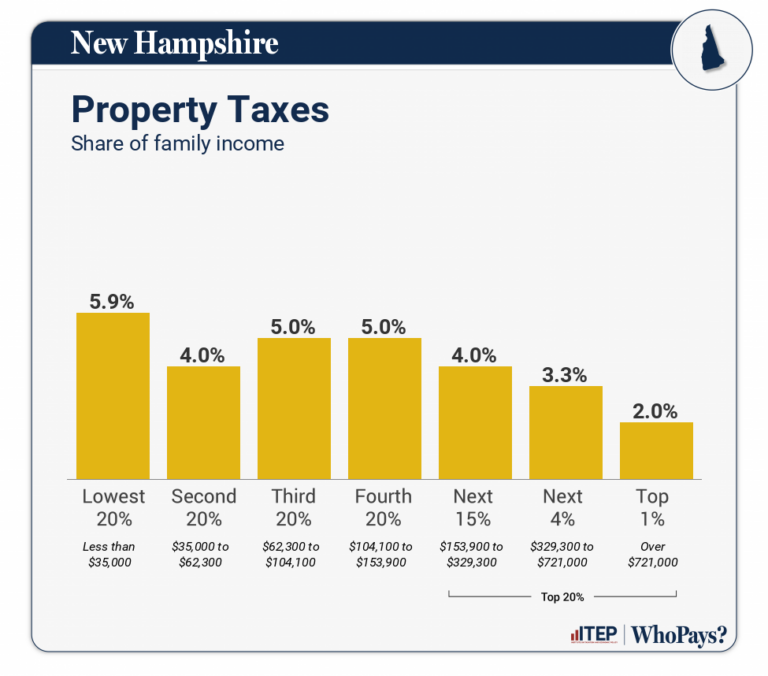

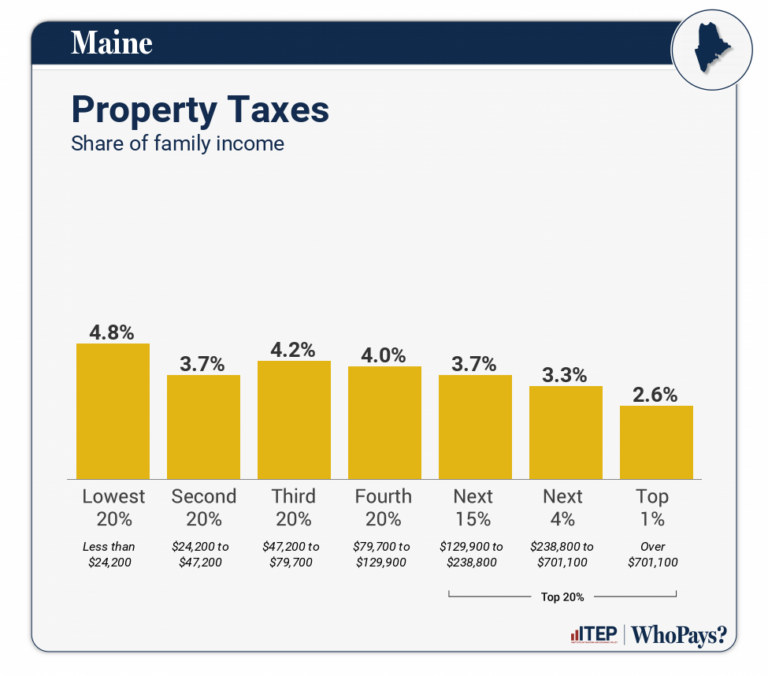

- Many states with flat or no income taxes also look to property taxes to raise revenue. New Hampshire, which has no personal income tax, relies heavily on property taxes to make up revenue, resulting in the third highest property tax rate in the nation. All but the wealthiest 5 percent in New Hampshire pay a greater percentage of their income in property taxes than families in Maine.

- On average in the US, the top 20 percent of earners pay a smaller share of their income in taxes while the bottom 80 percent pay a larger share. In Maine, we’ve improved tax fairness by increasing tax credits that prioritize working families with low income. But we can and should do more to make Maine’s tax system fair and equitable for all.

You get what you pay for

- “Low tax” states have fewer services and greater inequality. In Tennessee, a state that does not collect income taxes or provide refundable tax credits to families with low income, Black and Hispanic families face average effective sales and excise tax rates that are 28 percent higher than white households. Tennessee is also the 10th stingiest state when it comes to spending on children’s health, education, and economic supports and consistently underperforms on measures of child well-being when compared to Maine.

- It takes longer for “low tax” states to recover from crises. When Maine responded to the Great Recession by cutting taxes and gutting services, the result was deep cuts to revenue, more than 1,800 laid off state workers, almost $2 billion in forfeited federal funds, and a painfully sluggish 10-year recovery that was among the worst in the nation. By contrast, Maine’s recent pandemic response directed funding to public health, education, and support services, maximized federal funding, and targeted assistance to people with the greatest need. The approach resulted in economic and job growth stronger than the national average [1], prompting conservative economists to give Maine’s pandemic response an A grade.

If only lawmakers talked about tax dodgers as much as tax cuts

- The US loses about $688 billion in unpaid taxes every year, representing a quarter of federal tax receipts and about 3 percent of the nation’s total economic output. This gap is primarily the result of evasion by wealthy people and corporations. In Maine, corporate tax avoidance schemes go largely undetected.

- In 2020, 55 of America’s largest corporations paid zero in federal taxes because of tax loopholes and giveaways, at a cost of $180 billion each year. We don’t even know the full extent of the problem in Maine because we have no corporate tax transparency. We do know Maine loses over $1 billion each year to business tax subsidies and exemptions.

Notes:

[1] MECEP analysis US Bureau of Economic Analysis, Quarterly GDP by State in chained 2012 dollars

All charts can be found in ITEP’s most recent Who Pays? report.