Governor LePage’s budget would repeal the homestead exemption and increase property taxes for an estimated 213,000 Maine homeowners by more than $300 a year on average. Particularly hard hit would be homeowners living in towns with high mil rates and low income homeowners who have a larger portion of their property tax bill shielded by the homestead exemption.

For a PDF version of this issue brief, click here.

Facts & Figures$23,000 – Avg tax cut for Top 1% under LePage budget 80% – Percent of Maine families seeing a tax increase under LePage budget $15.64 – Avg mil rate for Maine communities in 2015 $12.78 – Avg mil rate for Maine communities in 2010 $1,000,000,000 – Amount of property taxes needed to compensate for state underfunding local education, since 2011 69% – Percent of homeowners in Maine below the age of 65 213,000 – Number of homeowners losing their Homestead Exemption under LePage budget $313 – Avg property tax reduction from the Homestead Exemption |

The property tax increases resulting from the elimination of the homestead exemption proposed in the governor’s budget do not pay for better schools, or fixing potholes, or paying firefighters. Instead the governor shifts more costs onto Maine homeowners, fails to fully fund education like voters just demanded, and cuts even more funding from local towns to pay for huge tax cuts for the wealthiest Mainers.

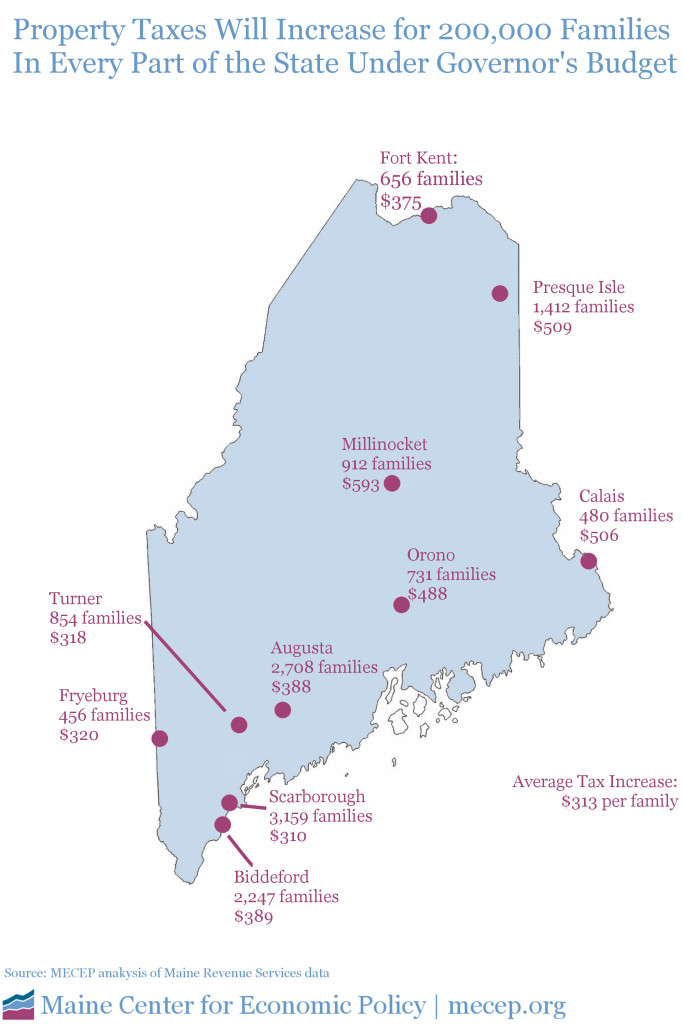

Homeowners Across Maine Are at Risk

Approximately 213,000 Maine homeowners are at risk of higher property taxes if the governor succeeds in repealing the homestead exemption for homeowners under age 65.

The value of the homestead exemption varies by town, and depends on a town’s property tax rate (also known as the ‘mil rate’). In 2017, those who qualify receive a reduction of $20,000 in the taxable value of their home.

According to Maine Revenue Services data, the average property tax rate in 2015 was 15. 64 mils ($15.64 per $1,000 of property value), which values the homestead exemption at 15.64 x 20 = $312.80. For residents of a town with a property tax rate of 12 mils, the exemption is worth $240 annually; for residents of a town with a property tax rate of 20 mils, the exemption is worth $400 annually. Eliminating the program would therefore increase property taxes by a similar amount.

Homeowners in Towns with Struggling Economies Will Likely See Even Greater Property Tax Increases

Property taxes have risen significantly over the last several years even as municipal leaders have cut and thinned out local budgets. State cuts to revenue sharing and other state policies like failure to fully fund education have taken their toll on municipalities’ abilities to keep property taxes affordable.

Towns with struggling economies are even worse off. They tend to have higher tax rates to compensate for reduced property values and higher demand on services. The highest mil rates in the state can be found in towns like East Millinocket, Waterville, Lewiston, and Eastport. The repeal of the homestead exemption would therefore have a greater impact on homeowners in those communities where residents already feel pinched, and compound the impact of previous cuts to targeted property tax assistance programs. Appendix A provides data by town on property tax increases and number of homeowners affected.

Tax Fairness at Stake

The homestead exemption is an important tool for improving tax fairness by reducing a greater share of property taxes paid by low-income homeowners. That’s because low-income Mainers tend to have houses valued less than high-income Mainers. While the homestead exemption shields the first $20,000 in home value from taxation for all eligible homeowners, low-income homeowners ultimately pay taxes on a smaller share of their home value. This means that the homestead exemption reduces effective property tax rates most for low-income homeowners.

In addition, the governor’s budget uses the money saved by eliminating the homestead exemption to help pay for income tax cuts for wealthy Mainers. The combined effects of these changes means that low- and middle-income Mainers will pay a greater share of their income in state and local taxes than before, while upper-income Mainers will pay less.

Conclusion

The governor’s proposal to cut income taxes for wealthy Mainers while raising property taxes for homeowners under the age of 65 is a step in the wrong direction. It shifts more costs onto low- and middle-income families already stretched by rising costs and stagnant wages. It also makes Maine’s tax system even more unfair than it was before. Wealthy families already pay a smaller share of their income in state and local taxes than everyone else. This proposal distorts that picture even more.

Governor LePage’s upside down tax plan is not the recipe for a thriving economy that works for everyone. It undermines our ability to invest in a stronger workforce, help young families succeed, build modern infrastructure, provide services our communities rely on, and address the priorities that benefit all Mainers now and in the future. Mainers, especially those who are working hard to make ends meet, deserve better.

Click here for a list of towns with average property tax increases and number of households affected (Appendix A).

Click here for a pdf of this brief.

Click here for an interactive map depicting average property tax increases and number of households affected. This site also provides access to the data depicted in Appendix A.