To view this press release as a PDF, click here.

On the day lawmakers initiate public hearings on governor’s budget, MECEP releases new town-by-town data showing many Mainers will pay more in property taxes and joins opponents in speaking against governor’s budget

|

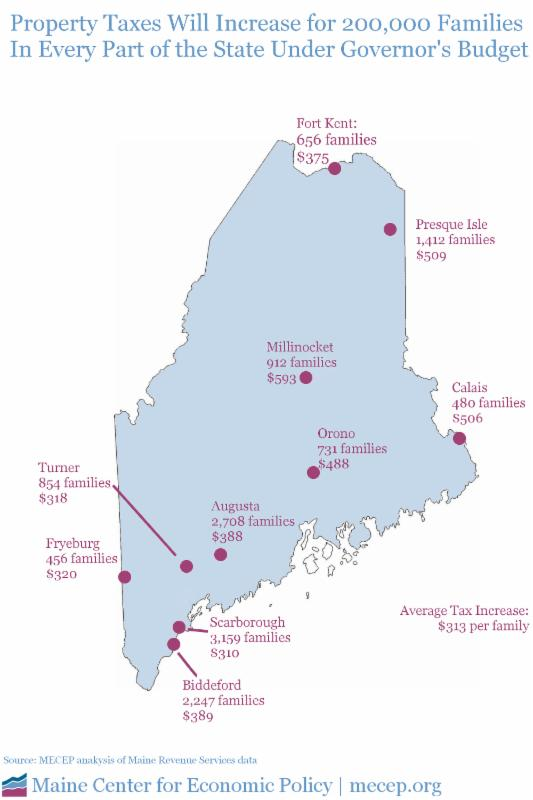

Augusta, Maine (Monday, February 6, 2017) More than 210,000 households would pay $313 more in property taxes on average if Governor LePage’s budget passes, according to Maine Center for Economic Policy (MECEP) analysis of data from Maine Revenue Services. The issue brief, “Governor’s Proposed Cuts to Homestead Exemption Would Raise Property Taxes for Maine Homeowners” notes that homeowners living in towns with high mil rates would experience the greatest property tax increases. Property Tax Increase by Select Towns Due to Governor’s Proposed Repeal of the Homestead Exemption for Homeowners Under Age 65

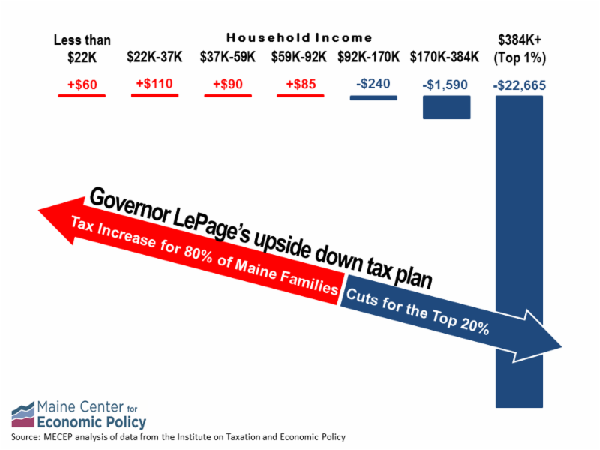

To see MECEP’s issue brief including a complete town by town listing click here. For an interactive map with above data mapped for all towns click here. The governor’s proposal to repeal the homestead exemption for Maine homeowners under the age of 65 is part of a larger budget plan that would ultimately raise taxes on households with income below $92,000 while giving an average tax cut of approximately $23,000 to the wealthiest 1% of Mainers. Governor’s Budget Includes an Upside Down Tax Plan that Would Raise Taxes on the Lower 80% of Maine Households

“Maine people deserve to know what the governor’s budget proposal means to them. Repeal of the homestead exemption for most Maine homeowners, combined with other tax changes in the governor’s proposed budget, doesn’t help pay for better communities or schools. Instead, the LePage tax plan takes money from poor and working class Mainers to pay for huge tax cuts for the rich,” said Garrett Martin, executive director at MECEP. “We need a real plan that doesn’t just cut taxes for the wealthy and corporations while leaving everyone else holding the bag. Lawmakers should reject the governor’s budget and work together to craft a budget that invests in a stronger workforce, helps young families succeed, builds modern infrastructure, provides services our communities rely on and addresses the priorities that benefit all Mainers now and in the future,” Martin stated. MEDIA AVAILABILITY TODAY WHAT: Maine Center for Economic Policy (MECEP) releases new analysis on the impact of the governor’s proposal to repeal the homestead exemption for families under age 65 and is joined by opponents of the governor’s budget proposal to outline the ways in which the governor’s proposed budget would hurt Maine families, schools, and communities WHEN: Monday, February 6th, 9:45 am WHERE: Welcome Center, State House, Augusta WHO: Sarah Austin, Policy Analyst, Maine Center for Economic Policy Teresa Gillis, Brunswick School Board Member John Kosinski, Yes on 2, Campaign Manager Summary Graphics |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||