The Maine Sunday Telegram’s (MST) recently published, above the fold, front page story on the impacts of Governor LePage’s tax plan comes up short in its analysis of the costs and benefits to Maine families of the LePage tax plan. Aside from overstating the benefits from proposed income tax changes, the article fails to account for the impact of proposed sales and property tax changes on the bottom line for Maine household budgets. It also overlooks the implications of the governor’s prioritizing tax cuts over needed investments in our schools and communities. Ultimately, the governor’s tax plan comes at a much greater cost to taxpayers, schools, and communities than the MST article suggests.

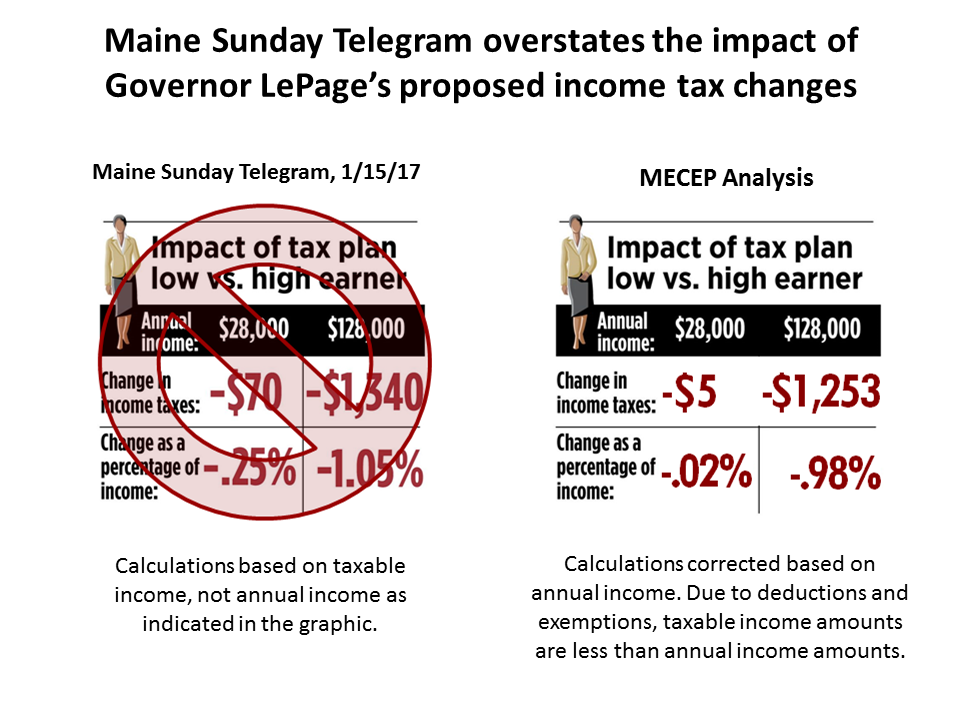

At the center of the MST analysis are two graphics that purport to depict the impact of proposed income tax changes on a sampling of “representative” Maine households. The graphics overstate the actual impact that proposed income tax changes will have on most Maine families, especially low- and moderate income wage earners. Below is a side-by-side comparison of the first MST graphic with corrected numbers based on MECEP’s analysis.

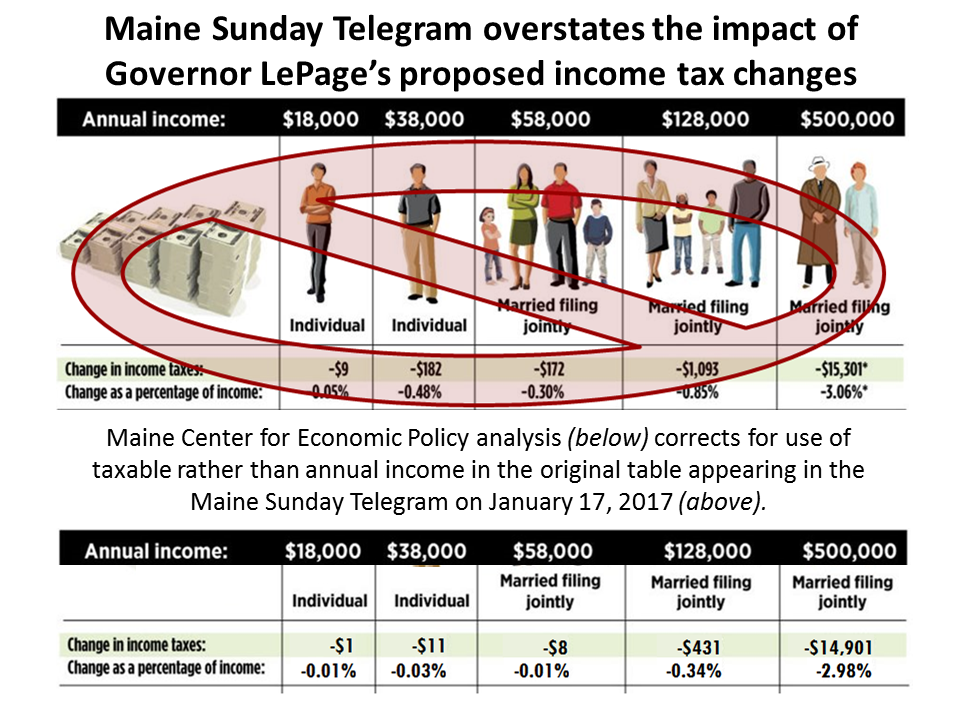

Here’s the second graphic, similarly corrected based on MECEP’s analysis.

The MST erroneously based its calculations on taxable rather than annual income, an important distinction since taxpayers adjust annual income based on deductions and exemptions to obtain taxable income. A family of four earning $58,000 a year does not pay tax on the full $58,000 in income. By claiming the standard deduction and available exemptions as most families do, their taxable income is significantly less―a little more than $16,000. They only pay tax on the $16,000 (i.e. taxable income) not the $58,000 (i.e. annual income). That’s a huge difference. For more on how taxable income is calculated, see MECEP’s brief.

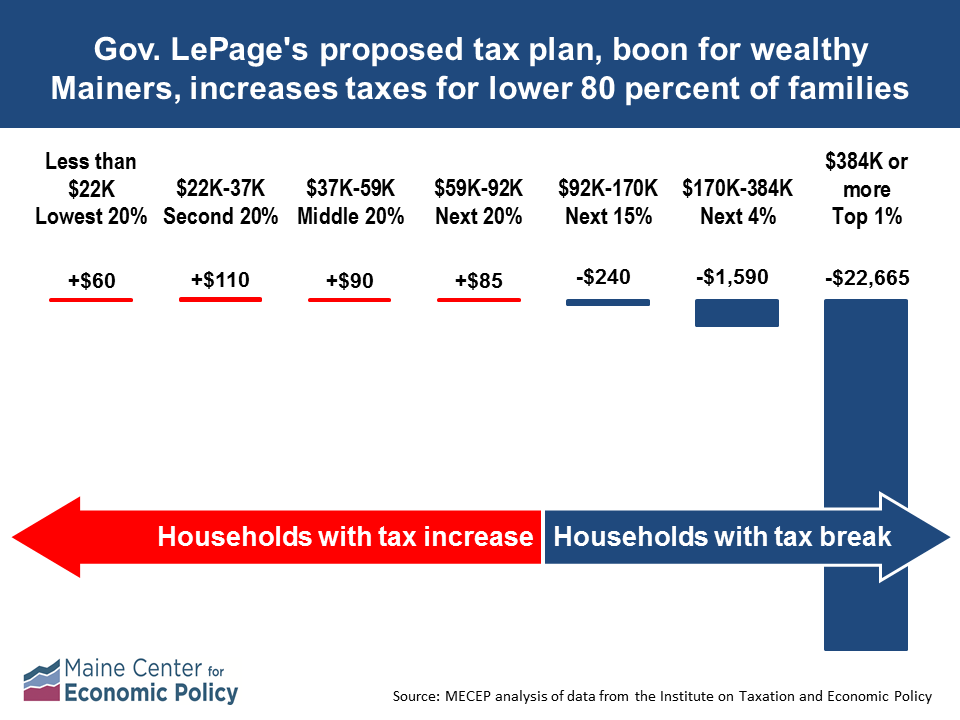

The MST also does not factor in the governor’s proposed new sales taxes and elimination of the Homestead Exemption for households under age 65 in its calculations. MECEP’s more in-depth analysis accounts for these changes as well as the governor’s other proposals to increase the pension exemption for retirees and modestly increase the property tax fairness credit that will result in lower taxes for some households. Accounting for these changes, the impact of the governor’s tax plan for Maine families looks quite different. The key take away from MECEP’s analysis, summarized in the chart below, is that the governor’s upside-down tax plan will raise taxes on average for people with income below $92,000 a year while cutting taxes by almost $23,000 on average for the top 1% of Mainers.

The state’s budget presents an opportunity to solve shared problems and to enact a plan that supports thriving communities and promotes opportunity for current and future generations of Mainers. The governor’s proposal with its upside-down tax plan and drastic reduction of resources available to invest in Maine’s schools and communities squanders that opportunity. Lawmakers should quickly dispose of the governor’s proposal so they can begin work on crafting an alternative that provides the resources needed to boost Maine’s economy and promote shared prosperity for all Mainers.