LD 1519 will create a $52 million budget hole

Legislators passed a bipartisan budget last year that funds schools, communities, and programs that give a hand up to those most in need. The budget also cuts income taxes for 83% of Mainers and improves the overall fairness of Maine’s tax system by reducing property taxes for all homeowners and boosting after-tax income for low- and middle-income families.

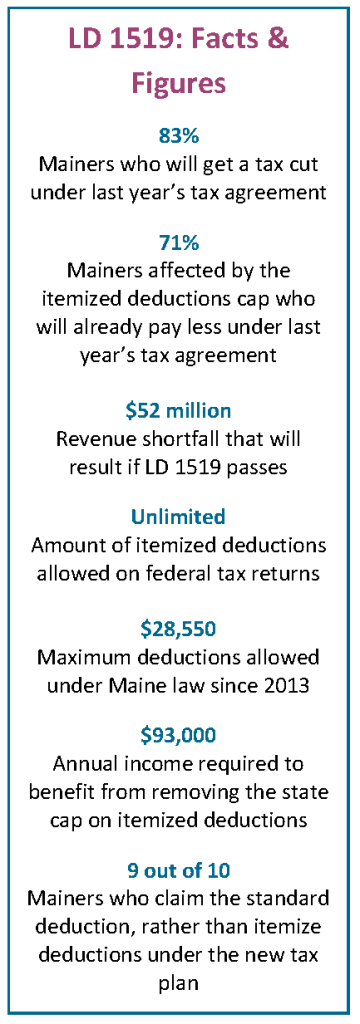

Efforts to roll back important provisions of the tax plan threaten to unravel these achievements and funnel millions in tax cuts to the wealthiest Mainers. Specifically, LD 1519 eliminates the $28,550 cap on itemized deductions in effect since 2013 and made permanent in last year’s bipartisan budget deal. If this proposal passes it will compromise our ability to fund our schools and communities and make Maine’s tax system less fair.

Efforts to roll back important provisions of the tax plan threaten to unravel these achievements and funnel millions in tax cuts to the wealthiest Mainers. Specifically, LD 1519 eliminates the $28,550 cap on itemized deductions in effect since 2013 and made permanent in last year’s bipartisan budget deal. If this proposal passes it will compromise our ability to fund our schools and communities and make Maine’s tax system less fair.

Lawmakers should reject LD 1519 and retain the cap on itemized deductions. Changes to last year’s budget must be paid for and not raise taxes on low- and middle-income Mainers.

Here are five things you should know about LD 1519:

1. It will jeopardize funding for schools and other important services.

The itemized deduction cap generates approximately $52 million in revenue that is helping fund schools, provide services, and protect public safety and the environment. Eliminating the cap will increase future budget shortfalls and erode the state’s capacity to maintain critical services and infrastructure for Maine people, businesses, and communities.

2. It will have minimal impact on charitable giving.

Proponents of LD 1519 cite research that fails to consider the combined impact of limiting itemized deductions and lowering income tax rates. Of the Mainers who are affected by the cap on itemized deductions, 71% will owe less income tax as a result of the new tax plan. This is because in addition to capping itemized deductions, the budget deal significantly reduced income tax rates. As a result, the vast majority of Mainers affected by the cap will be able to afford larger, not smaller, contributions because they will have larger after tax income.

3. It will not affect homeownership.

The mortgage interest deduction has no impact on homeownership, home values, or real estate transactions. High income homeowners who can afford more expensive homes are the taxpayers that are most likely to claim mortgage interest in their itemized deduction. These homeowners can afford their homes without tax assistance. Low- and middle-income homeowners, the population most likely to struggle with housing insecurity, are more likely to claim the standard deduction and receive no benefit from the mortgage interest deduction.

4. It is a huge give away to the wealthy.

Half the benefit of eliminating the cap goes to the top 1% of Mainers. People with income above $390,000 will get an average tax cut of approximately $4,000. Nearly all of the remainder of the benefit goes to the remaining top 20% of Mainers whose incomes are between $93,000 and $390,000. Mainers with income below $93,000 will not receive any benefit.

5. It will jeopardize the fairness of Maine’s tax system.

If the cap is removed, it is likely that lawmakers will ultimately pay for it by raising taxes on low- and middle-income Mainers. That’s unfair for working families. Any proposal to remove the cap must not shift costs to low- and middle-income Mainers or jeopardize funding for schools and other important services.

Last year’s bipartisan budget deal was a significant accomplishment. Reinstating a costly “upside-down” subsidy for Maine’s wealthiest taxpayers that offers little or no benefit for low- and middle-income families is a step backward.

The Maine Center for Economic Policy is a non-partisan, non-profit policy research organization committed to advancing economic justice and prosperity for all Maine people.

Itemized Deductions Frequently Asked Questions

How do itemized deductions work?

Itemized deductions provide a way for people to reduce their taxable income. This is done by subtracting the value of mortgage interest payments, charitable contributions, medical expenses, and other qualifying expenses from total gross income before calculating taxes owed. People can also deduct their state and local taxes from their federal taxable income.

Who can claim itemized deductions?

Anyone can claim itemized deductions, but they have a choice between the standard deduction and itemized deductions. The standard deduction is a set amount based on tax filing status and most people will choose the larger of the two options.

Are certain people more likely to claim itemized deductions than others?

Wealthy people are most likely to claim itemized deductions because they can afford higher mortgage interest payments and charitable contributions than low- or middle-income households and tend to pay more in state and local taxes. People with significant medical expenses are also more likely to claim itemized deductions. In 2013, 96% of taxpayers with income over $200,000 itemized their deductions compared to 26% of taxpayers with income below $200,000.

How many people claim itemized deductions?

Fewer than 3 in 10 Maine taxpayers claimed itemized deductions in 2013. Slightly more than 7 in 10 taxpayers claimed the standard deduction, valued at $6,300 for single filers and $12,600 for married filers in 2013. Last year’s budget deal increased the value of the standard deduction to $11,600 for single filers and $23,200 for married filers meaning nearly 9 in 10 people will claim the standard deduction in the future.

How do recent changes to itemized deductions in Maine work?

The budget deal includes two provisions that affect non-medical itemized deductions. First, it made permanent a cap on non-medical itemized deductions. In tax year 2016, the cap will prevent Mainers from deducting more than $28,550 from their taxable income. Second, the budget phases out standard and itemized deductions for taxpayers above certain income levels. The maximum value of deductions declines for single filers starting at $70,000 in income until they are eliminated at $145,000 in income. For those married and filing jointly, the phase out begins at $140,000 and ends at $290,000 in income. It is important to note that these changes coincide with changes to Maine’s tax brackets and tax rates. As a result, most taxpayers affected by the changes to itemized deductions will still pay less in taxes than before.

Is Maine’s treatment of itemized deductions different from other states?

Yes and no. In states that lack a broad-based income tax like New Hampshire and Washington, there is no benefit to itemizing deductions for taxpayers at the state level. Some states including Connecticut, Massachusetts, and New Jersey do not allow itemized deductions while other states like Maine and Wisconsin have caps and/or phase-out provisions that are stricter than federal rules.

For a PDF of this document, click here.