Lawmakers Hear How Governor’s Budget Will Benefit the Rich at the Expense of Maine Kids, Families, and Communities

|

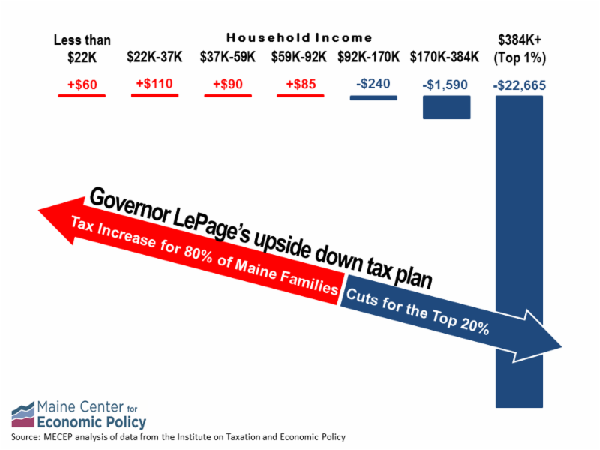

To view this release as a PDF, click here. (February 10, 2017) Augusta, Maine – State legislators on the appropriations and taxation committees are holding a public hearing today on key tax proposals in Governor LePage’s budget plan. Maine Center for Economic Policy Analyst Sarah Austin is one of dozens of Mainers testifying in opposition to the governor’s budget plan in Augusta today. The LePage budget would undo Question 2, the ballot initiative passed by Maine voters in November 2016, which would finally fulfill the state’s obligation to provide 55% of school funding. It also would increase taxes on the 80% of Mainers making less than $92,000 a year and would cut important state services in order to give massive tax breaks to the top 1% of Maine households. “The governor’s budget defies the interests and will of Maine people,” said Sarah Austin. “Mainers just told us they support building a stronger public education system by asking wealthy Mainers to pay their fair share. Voters indicated they want more opportunities for Maine students, not less. “This tax plan is bad for the economy. Maine has the resources to be proactive in making the kind of investments that lay the foundation for a strong economy. Cutting taxes for the rich at the expense of everyone else is a recipe for economic failure and more hardship for Maine’s working families and seniors. “The tax plan laid out by the governor cannot support a prosperous state. To balance costly tax cuts that primarily benefit the wealthiest Mainers, the governor cuts health care for Maine families, cuts funding for schools, and shifts even more costs onto towns and property taxpayers. “Maine’s economic recovery has been slower than the nation’s – in large part due to Governor LePage’s cuts in previous years – but we are finally seeing modest signs of economic growth reflected in increasing state revenues. In addition, voters approved new revenue to finally fund schools. The next two years are not a period of scarcity. We can fund current critical state and local services, we can fund schools at the level voters demanded, and we can look at new investments that will brighten Maine’s future. “We urge the committee to reject the governor’s proposal and instead protect the fairness of current tax law and invest in better schools, better paying jobs, and stronger communities.” The following materials were provided to committee members as part of MECEP’s testimony:

Summary of tax impacts for representative households as a result of proposed tax changes contained in Governor LePage’s FY18/19 budget proposal

A more comprehensive version of this chart including more detail about assumptions and notes concerning the impact of specific tax changes can be found here. Governor’s proposed budget distributional analysis for Maine families by income |