“Now that Question 2 is law, Maine has a bona fide path to fully funding education in 2018 and the wealthiest 1% of Maine households still pay a lower effective tax rate than the middle 75% of Maine families. Walking back the surcharge in any way will serve to further privilege wealthy Mainers, shift more costs onto low- and middle-income families, and jeopardize education funding. However, some lawmakers and special interest groups seem to advocate for just that.”

for a PDF of this testimony as delivered, click here.

Good afternoon Senator Dow, Representative Tipping, and honorable members of the Joint Standing Committee on Taxation. My name is Sarah Austin, a policy analyst with the Maine Center for Economic Policy. I’m here to testify against LD 291, LD 337, LD 551, LD 829, LD 851—all of which undermine the will of Maine voters and the fairness of Maine’s tax system.

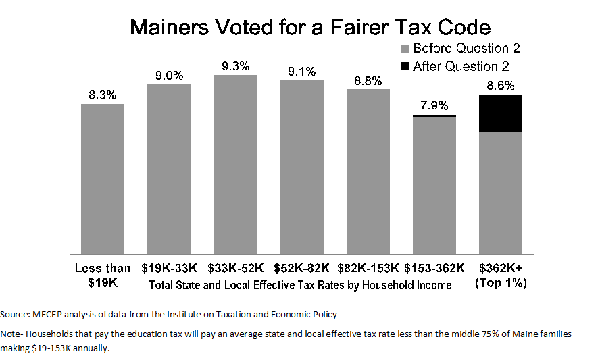

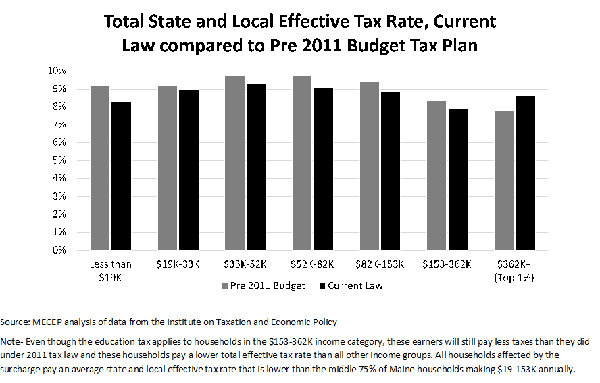

Before voters passed question 2, which instituted a 3% tax on household income over 200,000 to fund public education, our state and local tax system asked less of the wealthy than it did of low and middle income Mainers.[i] Successive tax cuts that predominantly benefited wealthy Mainers resulted in the wealthiest 1% receiving an average tax cut of $4,000 compared to 2012 tax law. These expensive tax cuts pit priorities like healthcare and education against one another and shifted over 1 billion dollars in property tax increases to towns because of the state’s failure to uphold a 2004 voter referendum to fully fund education at 55% of EPS.

Now that Question 2 is law, Maine has a bona fide path to fully funding education in 2018 and the wealthiest 1% of Maine households still pay a lower effective tax rate than the middle 75% of Maine families. Walking back the surcharge in any way will serve to further privilege wealthy Mainers, shift more costs onto low- and middle-income families, and jeopardize education funding. However, some lawmakers and special interest groups seem to advocate for just that.

The governor proposed repeal of question 2 in his budget, and his administration presented baseless analysis to this committee claiming that a mass exodus of the wealthy will occur if our tax code requires the top 1% to pay just below what most other Mainers pay in an effective tax rate. The administration’s analysis provides no basis and their assumptions contradict the evidence. The large majority of peer reviewed research finds that state tax migration is statistically and economically insignificant.[ii]

Representatives of the business community are here to claim this law will cause hardship for small businesses, but a look at the data shows that personal income taxes of pass through entities make up only 4.5% of state and local revenue collected from businesses in our state. Property taxes on the other hand, make up 54.8% of state and local revenue collected—the highest proportion in the country.[iii]

State cuts to revenue sharing and general assistance and failure to fully fund the state’s share of education costs have shifted more costs onto local property taxpayers—both businesses and families. In fact, Maine property taxes are nearing historic highs and most businesses stand to gain from less pressure on local property taxes thanks to the education tax. Almost all businesses have some property tax costs – for a store front, home office, or big equipment – and owe property taxes each year regardless of the size of their profits. However, nationally only about 10% of pass through businesses report taxable income over $200,000, and most businesses that do aren’t your typical small business, the vast majority of partnership income in this group comes from lawyers and finance firms.[iv]

Voters recognized the need to stop the shift to property taxpayers. The pressure to raise property taxes eases when the state fully funds its share of education. Repealing the education tax will give a huge tax cut to the wealthiest Mainers and continue the tax shift onto property taxpayers resulting in a tax system that asks the least of the wealthiest Mainers and businesses.

LD 571 eliminates the approximately 150 million raised annually by the education tax and offers marijuana revenue that raises 11 million a year as the only guaranteed revenue replacement. This is not what Mainers voted for. This bill would be a step backward in ensuring adequate revenue for schools and would rely on a regressive tax to help pay for the tax cuts for the rich that are the centerpiece of the legislation.

LD 829 increases the thresholds for head of households and married filing jointly households and would likely cut the revenue in half. This bill intends to remove the tax from small businesses, but the mechanism is poorly targeted, cutting taxes for all filers affected by the tax, business or not, and giving the biggest tax cuts to the wealthiest filers.

I urge this committee to respect the will of Maine voters, protect Maine’s ability to invest in our future by fulfilling our commitment to public education, and stop the trend of tax cuts for the wealthy at the expense of families and communities. I urge this committee to reject LD 291, LD 337, LD 551, LD 829, and LD 851.

End notes:

[i] See attached analysis of data from the Institute on Taxation and Economic Policy

[ii] Young et al. 2016. Millionaire Migration and Taxation of the Elite: Evidence from Administrative Data American Sociological Review. 81(3); Center on Budget and Policy Priorities. 2011. Tannenwald, et al. Tax flight is a myth: Higher state taxes bring more revenue, not more migration. Available at: http://www.cbpp.org/research/tax-flight-is-a-myth

[iii] Total state and local business taxes, State by state estimates for fiscal year 2014. October 2015. Council on State Taxation and EY. Available at: http://www.ey.com/Publication/vwLUAssets/EY-total-state-and-local-business-taxes-october-2015/$FILE/EY-total-state-and-local-business-taxes-october-2015.pdf

[iv] IRS table 1.4; Cooper, et al. 2015. Businesses in the United States: Who owns it and how much tax do they pay? U.S. Treasury Department. Available at: http://www.ericzwick.com/pships/pships.pdf See attached excerpt of graphs