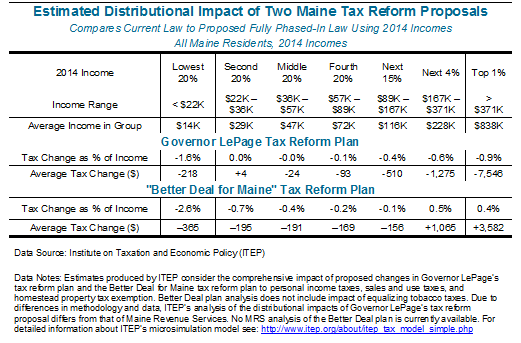

“The Better Deal for Maine plan would cut taxes, on average, for the bottom 95% of Maine taxpayers. It would reduce taxes more than the governor’s plan, on average, for the bottom 80% of Maine families.”

To download this document as a PDF, click here.

The Maine Center for Economic Policy worked with the Institute on Taxation and Economic Policy to develop a comprehensive distributional analysis comparing competing tax reform plans from Governor LePage and legislative Democrats.[i] The analysis shows that the Democrats’ “Better Deal for Maine” tax reform plan would reduce taxes more for most low- and middle-income Mainers.

The Better Deal for Maine plan would cut taxes, on average, for the bottom 95% of Maine taxpayers. It would reduce taxes more than the governor’s plan, on average, for the bottom 80% of Maine families.

Another major difference between the Better Deal for Maine plan and the governor’s plan is the impact on high-income taxpayers. Over half the benefits of Governor LePage’s plan accrue to the highest-income Mainers and come at the expense of funding for education, healthcare, and other critical services important to Maine people and businesses. [ii] Under the Better Deal plan the average tax cut for Mainers in the 80th–95th percentiles, those with annual incomes from $89,000 to $167,000, will be smaller than in the governor’s plan, and the top 5% of the income distribution, those with annual incomes greater than $167,000, will see a modest tax increase. These changes improve the fairness of Maine’s tax system and increase the state’s capacity to invest in schools and communities compared to the governor’s plan.

Overall, the Better Deal plan would make Maine’s state and local tax system more progressive. In contrast to the governor’s plan, it does not increase sales tax rates above current levels. It replaces the current individual income tax with a more progressive rate and bracket structure that retains the top marginal rate of 7.95% for individuals with income greater than $150,000 and families with income greater than $300,000. It provides more targeted property tax relief to Maine residents by doubling the homestead property tax exemption for all Mainers and increasing the size of the property tax fairness credit by the same amount the governor’s plan proposes. It would also adopt the governor’s plan for a refundable sales tax fairness credit to offset the impact of permanently higher sales tax rates and expansion of the sales tax to more goods and services.

The bottom line is that the Better Deal plan reduces taxes more than the governor’s plan for the vast majority of Maine families. And it does so without forcing future cuts to education, healthcare, and other critical services important to all Maine people and businesses.

[i]The Institute on Taxation and Economic Policy (ITEP) regularly assesses the fairness of state and local tax systems. Due to differences in methodology and data, ITEP’s analysis of the distributional impacts of Governor LePage’s tax reform proposal differs from that of Maine Revenue Services (the MRS analysis is located here: http://www.maine.gov/revenue/research/distributional_analysis_tax%20reform_2015.pdf). Detailed information about ITEP’s microsimulation model is available here: http://www.itep.org/about/itep_tax_model_simple.php

[ii]According to analysis from Maine Revenue Services, more than half of the approximately $292 million net annual tax cut in 2019 proposed by the Governor would accrue to the top 10% of Maine income earners—households earning more than $134 thousand per year. See table 7, column 10 of this document: http://www.maine.gov/revenue/research/distributional_analysis_tax%20reform_2015.pdf