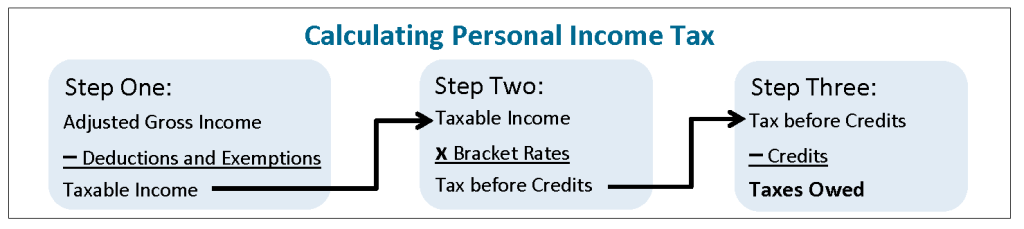

Mainers calculate their state personal income tax in three basic steps. The 2015 state budget changes how Mainers will calculate each step.

Step One: Calculate Taxable Income

Step One: Calculate Taxable Income

Most people don’t pay income taxes on their full income. Adjusted gross income is a filer’s income from all sources minus certain “above-the-line” deductions for things like college fund and retirement contributions. Filers then subtract deductions and exemptions from their adjusted gross income to calculate their taxable income.

Step Two: Calculate Income Tax before Credits

Step Two: Calculate Income Tax before Credits

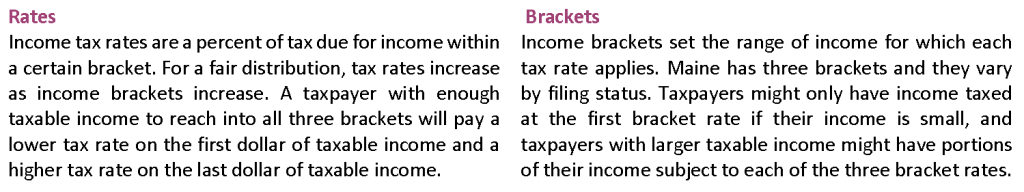

After calculating taxable income, filers apply tax rates based on income brackets to determine income tax owed before credits.

Step Three: Calculate Taxes Owed

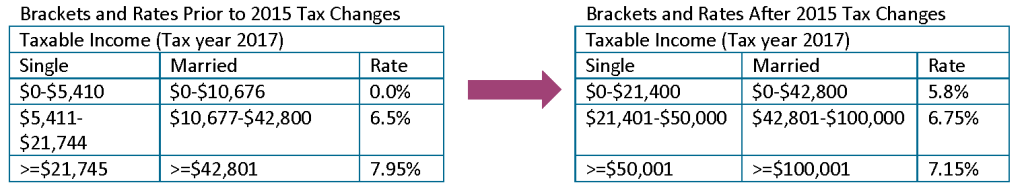

Filers subtract credits from the income tax calculated with brackets and rates. Depending on whether a credit is refundable, some income tax credits may result in a state refund check.

Significant Income Tax Changes in the 2015 Budget

Legislators paid for state and local services in the state budget with an overhaul of Maine’s income tax code that made changes to deductions, income brackets and rates, and credits. These changes were critical to both preventing cuts to important services and improving tax fairness. They also gave 86% of Mainers an income tax cut.

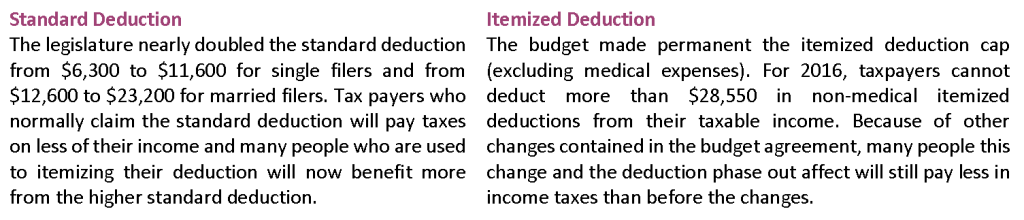

Changes to the standard and itemized deductions will affect the amount of income Mainers pay income taxes on.

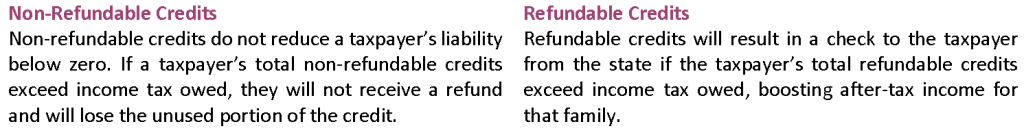

Although the first bracket rate increased from 0% to 5.8%, the increase in the standard deduction will hold harmless the Mainers who previously only had income taxed at the 0% rate. The expanded brackets will target the higher-income tax rates to higher-income Mainers, improving the overall tax system’s fairness.Expansion of the brackets and changes to the tax rates will result in a modestly more progressive income tax system.

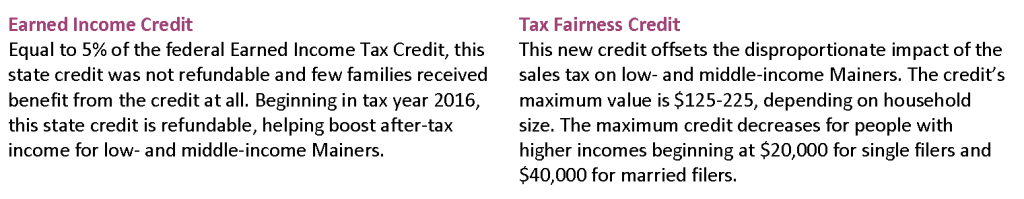

New refundable credits will boost after-tax income for low- and middle- income Mainers.

How the 2015 Budget Agreement Tax Changes Affect Maine Families

Last year’s budget agreement funds our schools and roadways, continues popular programs like heating and prescription drug assistance for the elderly, and preserves a portion of revenue sharing for communities across the state. The backbone of this budget agreement was a suite of tax changes that provides the funding for these state priorities and modestly improves the progressivity of Maine’s tax system.

These tax changes begin to take effect in tax year 2016 and phase in fully by tax year 2017. By 2017, 86% of Maine families will receive an income tax cut and 83% of Maine families will pay less in combined state and local taxes as a result of last year’s budget agreement. However, lawmakers are considering legislation this session (LD 1519) that threatens these achievements before they fully take effect. Upsetting the balance struck last session between responsible spending and tax cuts will likely result in a less progressive tax system and higher taxes for low- and middle-income Mainers.

How income tax changes help Maine families

Here are five ways the budget agreement will lower Mainer’s income taxes:

- Nearly 9 in 10 Mainers will claim the standard deduction. The higher standard deduction will cause over half of Mainers who currently itemize their deduction to claim the higher standard deduction. Nearly all Mainers who claim the standard deduction under the new tax plan will receive a tax cut.

- The budget agreement increased the lowest tax bracket rate from 0% to 5.8%. By increasing the standard deduction, legislators held low-income Mainers harmless from a rate increase.

- Most low- and middle-income Mainers who claim the itemized deduction have done so because they have mortgage interest that exceeds the standard deduction amount. The larger standard deduction for 2016 and beyond is much higher than the average mortgage interest low- and middle-income homeowners deduct. The standard deduction will offer greater benefit than the mortgage interest deduction to nearly all low- and middle-income homeowners.

- Many Mainers who itemize will pay less income tax because of the lower top bracket rate. Even many Mainers affected by the cap on itemized deductions will pay less income tax. The lower top tax rate and expanded brackets will result in a tax cut for 71% of Mainers who have their itemized deductions limited by the cap.

- Low- and middle-income Mainers will receive a boost in after-tax income through new refundable credits.

How other tax changes affect Mainers

Sales Tax

The budget agreement made permanent the temporary increase in the sales tax to 5.5%. The budget also expands the sales tax base and made prepared foods subject to the sales tax beginning in tax year 2016. The legislature created a tax fairness credit to offset the disproportionate impact of the sales tax on low- and middle-income Mainers.

Estate Tax

The budget agreement will shrink the estate tax base and conformed Maine’s estate tax brackets to the federal brackets. As a result, estates valued between $2 and $5.5 million will not be subject to this tax.

Increased Property Tax Relief

The budget agreement doubled the homestead exemption for all Maine homeowners from a $10,000 to $20,000 exemption by tax year 2017. Mainers across the state will benefit and pay less in property taxes as a result.

for a PDF version, click here.