Today, state legislators released details of a budget deal that, if passed, would avoid a state government shutdown. The deal includes significant changes to Maine’s tax code. The proposal:

-

Restructures the state’s tax brackets and rates;

-

Increases the standard deduction this year but then phases it out;

-

Phases out itemized deductions for upper income taxpayers;

-

Doubles the homestead exemption for all Maine resident homeowners;

-

Maintains the current 5.5% sales tax rate and the 8% tax on meals while increasing the lodging tax to 9%;

-

Introduces a refundable credit for low- and lower-middle income Mainers to offset sales tax increases; and

-

Makes Maine’s earned income tax credit refundable at its current level.

The two questions many observers are asking about the plan are:

-

Will it generate enough revenue in the future to maintain state funding for education, healthcare, and other vital public services?

-

How does it impact the overall fairness of Maine’s tax system?

Revenue Adequacy

It is hard to predict how much money the state will need to meet future state spending. The proposed deal definitely raises more money than either Governor LePage’s original budget proposal or the alternate tax plan Republican legislators put forth in May. Neither of those plans raised sufficient revenue to fund education, health care for seniors, and other spending priorities agreed to by Republican and Democratic legislators during budget negotiations. Because Maine’s Constitution requires a balanced budget, legislators have no choice but to adopt a revenue plan that is in balance with their spending plan.

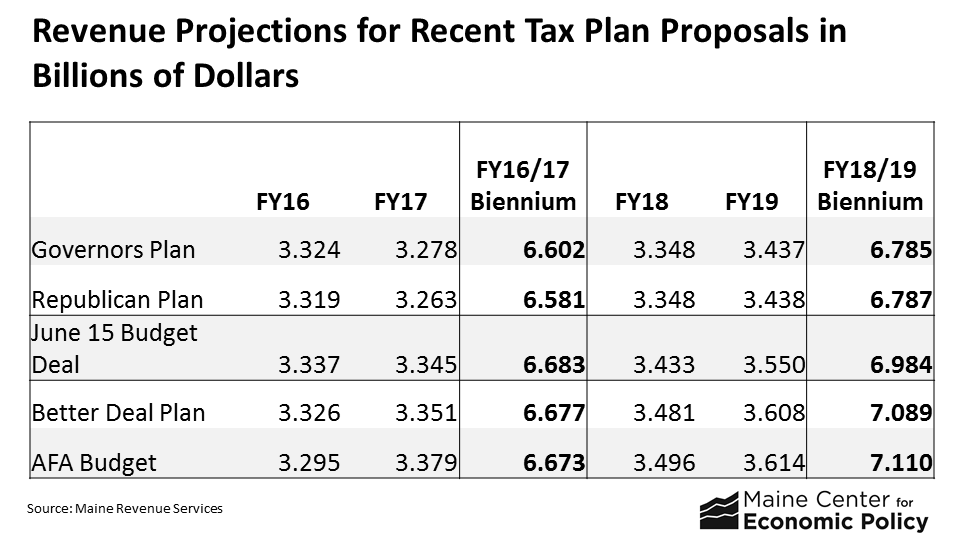

It is less clear whether or not revenues in the proposal will be adequate to maintain current spending in the future when adjusted for inflation. Both the Better Deal for Maine plan offered by Democrats in April and the majority budget proposal passed by the Appropriations Committee in a 9-4 vote, raise more revenue in the future. It is also unlikely that either of these plans would garner enough votes to become law. The table below highlights projected revenue for these plans:

The takeaway is that the new proposed budget deal doesn’t create the kind of future structural gap that the plans from the governor and legislative Republicans would. It is less clear whether or not the proposal will raise adequate revenue to maintain current levels of spending beyond the coming two year budget cycle.

Tax Fairness

MECEP is particularly interested in whether or not the current plan improves the progressivity of Maine’s tax system. That means that low- and middle-income Mainers should get a significant share of the benefits of any tax cut and that what they pay in the future as a share of overall state and local taxes should go down relative to what they pay today.

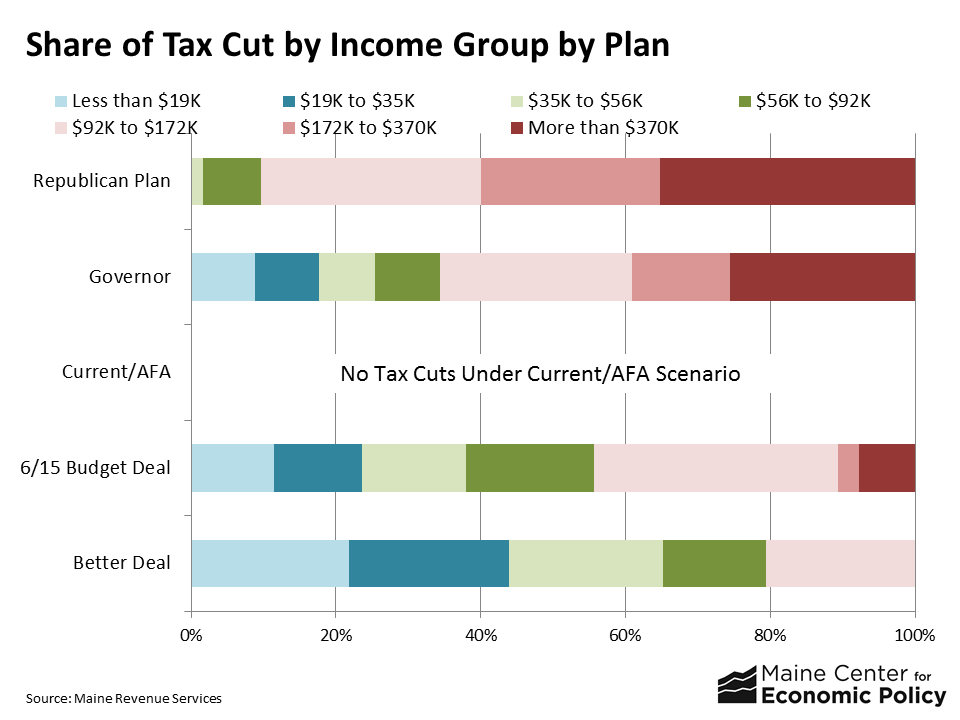

The current plan includes a sizeable income tax cut. Income tax cuts generally tend to deliver greater benefits to wealthier taxpayers who have more income especially when the proposal reduces top tax rates. With the exception of the budget proposal the appropriations committee passed, all the other major plans included income tax cuts. However, the structure of these cuts in each plan makes a big difference in terms of who wins and who loses. The legislative Republicans’ plan actually raised taxes on average for the bottom 60% of Mainers while giving significant tax cuts to those at the top. By contrast, the Better Deal plan from legislative Democrats lowered taxes on average for the bottom 95% of Mainers while raising them for the top 5%. The chart below summarizes the distribution of tax benefits by plan:

The current budget deal still delivers a sizeable share of the benefits to the top 20% of Mainers whose income is greater than $92,000. Because of the way the plan is structured, the top 5% still get a sizeable tax cut — approximately $1,500 on average for the top 1% whose income is greater than $370,000 — but this is far less than the $10,000 tax cut provided in both the governor’s and legislative Republicans’ plans. What’s more instructive is to assess how much each income group gets as a share of the overall tax cut. While the current budget deal does not go nearly as far as legislative Democrats’ Better Deal in targeting tax cuts to the bottom 80% of Mainers, it is a marked improvement over both the governor’s and legislative Republican plans. Mainers with income less than $92,000 get 56% of benefits in the current budget deal compared to 34% in the governor’s plan and 10% in the legislative Republicans plan.

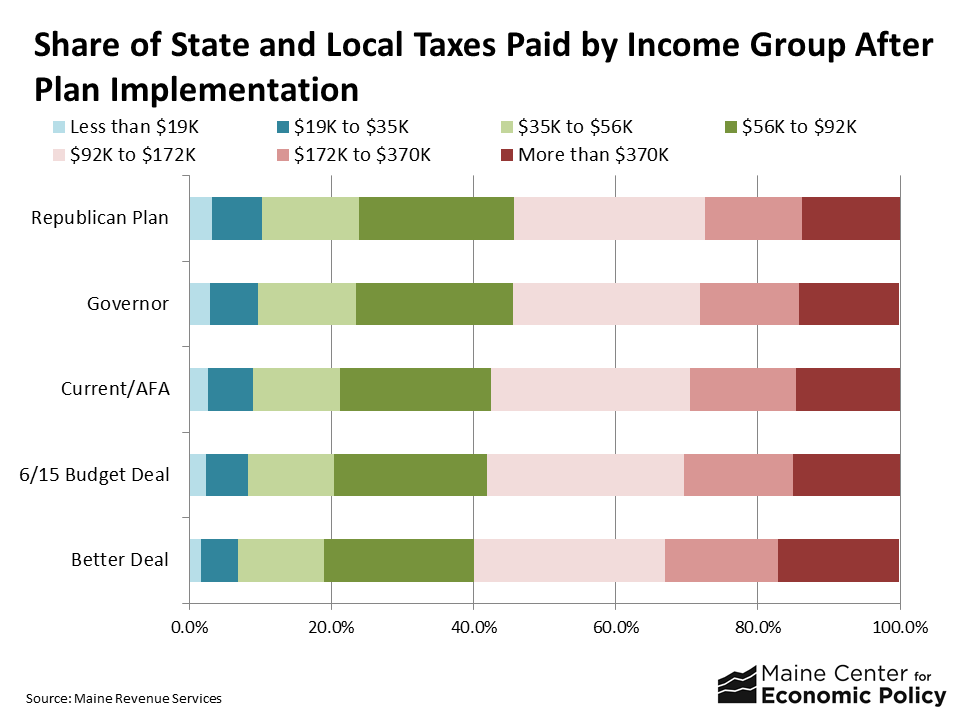

The distribution of benefits ultimately impacts the distribution of taxes each income group pays. If lower-income families wind up paying a smaller share of state and local taxes relative to upper-income families, that would suggest that the proposal improves the progressivity of the tax system. It is important to bear in mind that improved progressivity is often a game of inches rather than miles. Each incremental improvement is important. The chart below depicts the shift in the overall share of taxes paid by income group. The “Current/AFA” bar is the closest depiction to Maine’s current distribution based on data available from Maine Revenue Services.

This chart confirms that the current budget deal would result in a modest improvement in the progressivity of Maine’s tax system. As a share of total taxes paid, the top 20% would pay more than they do today while the bottom 80% would pay a smaller share. And that means that the proposal will make Maine’s overall tax system more fair than it is today.