Maine Needs a Plan to Revive the Economy

The state budget lays the foundation of a strong economy and thriving communities. For Maine to prosper, the budget must address shared problems and work to meet common goals. Good budgets raise enough revenue to make investments that build a stronger workforce, help young families make a good start, support modern infrastructure, and address other goals that benefit all of us now and in the future. However, recent state budgets undermined our ability to meet these goals and instead prioritized tax breaks for the wealthiest Mainers.

Tax breaks that have predominantly benefited wealthy Mainers and corporations jeopardized state capacity to make key investments in a healthier economy and the wellbeing of Maine people. For 2015, general fund spending as a percent of state GDP was at its lowest in 25 years apart from 2010 and 2011 when tax revenue was hard hit by recession. That means state revenue hasn’t kept pace with the costs of maintaining state services or making additional needed investments and costs have shifted to local communities as a result. The voter approved education funding initiative will help buck this trend by increasing taxes on high income households, but more changes are needed to grow and diversify revenue sources to invest in all the elements of a stronger economy.

The budget’s role in reviving Maine’s economy

Increasing the number of middle class jobs in Maine requires commitments to education, health care, and infrastructure. There are still fewer jobs in Maine than there were before the last recession. And new jobs are mostly lower skill and lower paying than the middle class jobs lost in the recession.

Investing in education at all levels will help produce the researchers, innovators, entrepreneurs, and skilled workers Maine needs to redefine our manufacturing industries and produce high quality products that will grow our economy and create middle class jobs.

Access to affordable health care is important to help families make ends meet and for workers to stay in the workforce. Maine’s deceptively low unemployment rate leaves out the high proportion of working age adults that have dropped out of the workforce for health reasons. Increasing access to affordable health care will help Mainers return to work and stay employed.

Businesses rely on quality infrastructure to be profitable. Modern infrastructure systems for high-speed internet, water, roads, and bridges lower business costs and help bring economic development to rural areas. Expanding investment in infrastructure will help economic growth reach areas beyond Maine’s urban centers.

Revenue and Spending TrendsEducation

Health Care

Infrastructure

|

Bonding

Bonding creates jobs and improves state infrastructure at low cost to tax payers. Since 2011, the state failed to take on adequate levels of bonding, allowing infrastructure to age and maintenance costs to increase, and foregoing economic boosts that infrastructure development can bring to local areas.

Bonding increases state investment with low upfront cost. State bonding can often be used to leverage additional federal funds to increase infrastructure investment and Maine’s strong bond rating keeps borrowing rates low.

Federal decisions could shift more costs to Maine

Federal lawmakers are debating plans to convert important programs like Medicaid and food stamps from entitlement programs to block grants. As a general rule, block grants do not keep pace with the true costs of program implementation and would mean less federal support for these programs in the long run. Block grants would also mean fixed funding for programs resulting in limited capacity to expand enrollment during economic downturns to help Mainers get back on their feet.

To protect Mainers from the potential threat of federal block grants, lawmakers should strengthen state revenues and reserves to make sure these programs are able to increase enrollments during recession when they are needed most.

Tax fairness

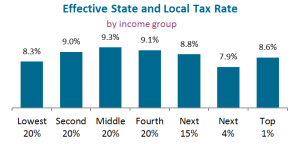

After implementation of the voter approved education funding initiative’s 3 percent tax on high income households, the wealthiest 1 percent of Mainers will still have a lower effective tax rate than the middle 85 percent of Mainers. Attempts to lower Maine’s income tax will benefit wealthy Mainers most and likely shift costs onto property tax payers.

After implementation of the voter approved education funding initiative’s 3 percent tax on high income households, the wealthiest 1 percent of Mainers will still have a lower effective tax rate than the middle 85 percent of Mainers. Attempts to lower Maine’s income tax will benefit wealthy Mainers most and likely shift costs onto property tax payers.

Building a Fiscally Responsible BudgetA good budget is one that covers costs and is paid for fairly. Approaching the process with a long term outlook can result in a fiscally responsible budget that will set the state up for economic success.

|

Click here for pdf of Making the Most of Maine’s Next Budget.