How to Submit Testimony for a Public Hearing in Maine

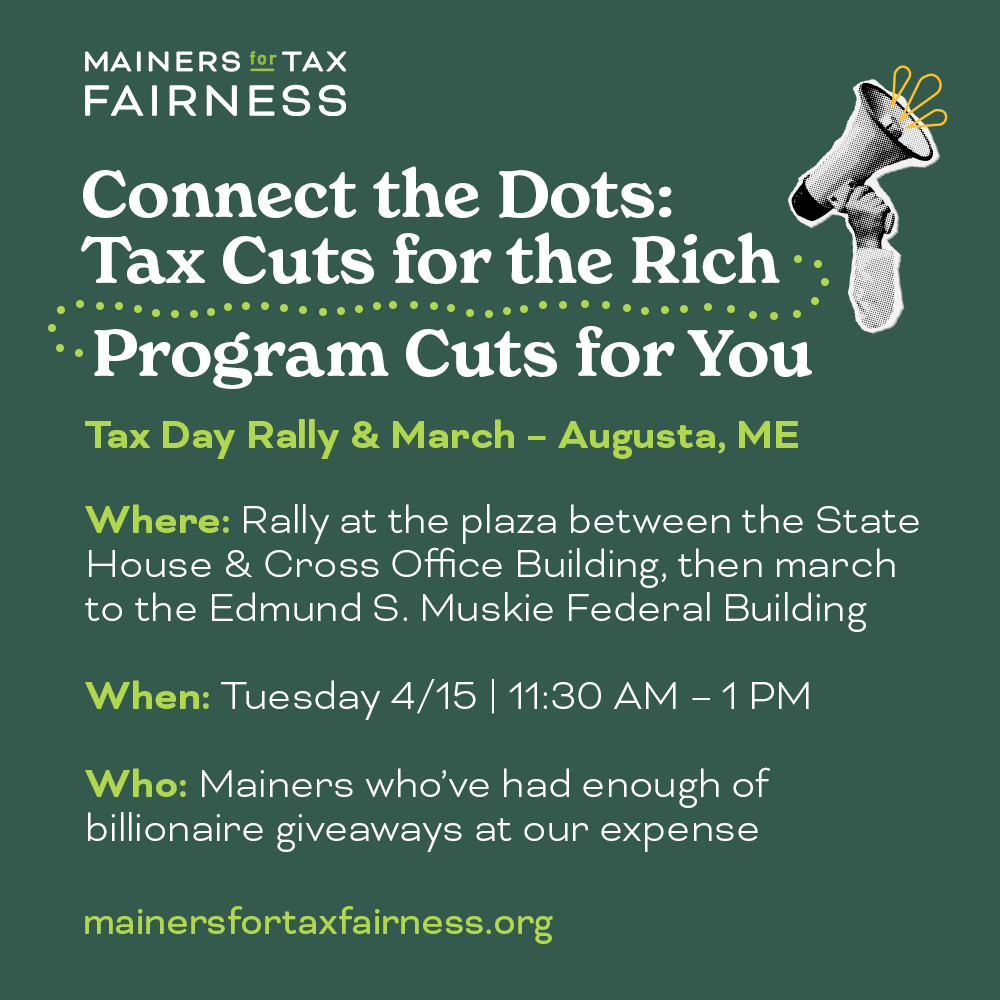

Tax Day Rally & March:

Connect the Dots in Augusta, ME

Congress is gutting Social Security, Medicaid, health care, education, veterans’ care and more — just to bankroll tax cuts for the ultra-rich. We’re not letting it slide. This Tax Day (April 15) join MECEP and other members of the Mainers for Tax Fairness coalition 11:30 AM – 1 PM for a rally at the plaza between the State House & Cross Office Building, then march to the Edmund S. Muskie Federal Building.

Newsletter sign-up

Sign up here to receive key information, in-depth analysis, and opportunities for action to advance economic justice in Maine.