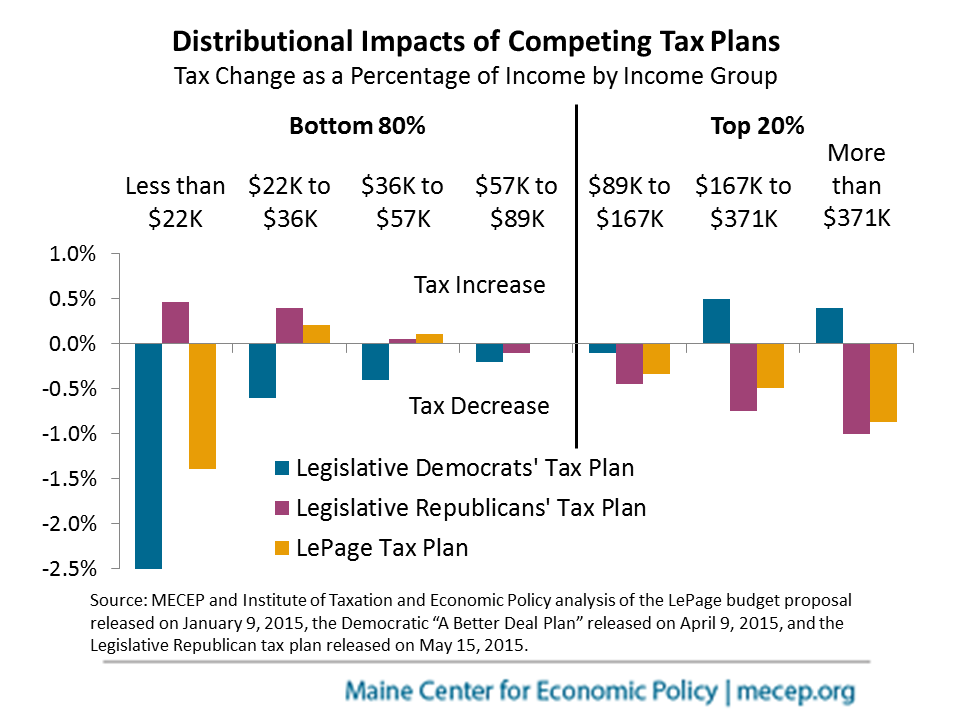

Republican legislators released their plan for overhauling Maine’s tax system last week. Yesterday MECEP posted a chart comparing the distributional impacts of the Republican and Democratic plans. The key takeaway from that chart was that Mainers whose income is less than $89,000 – the bottom 80% of all Maine taxpayers – fare better on average under the Democratic plan, while the top 20% of Mainers do better under the Republican plan.

The Republican and Democratic tax plans aren’t the only ones we’ve seen in recent months. Governor LePage’s tax plan jump-started the conversation on tax reform when he released it in January. While the governor’s plan lacks the legislative support it needs to become law, it provides a useful reference point for evaluating the policy choices of the different tax plans.

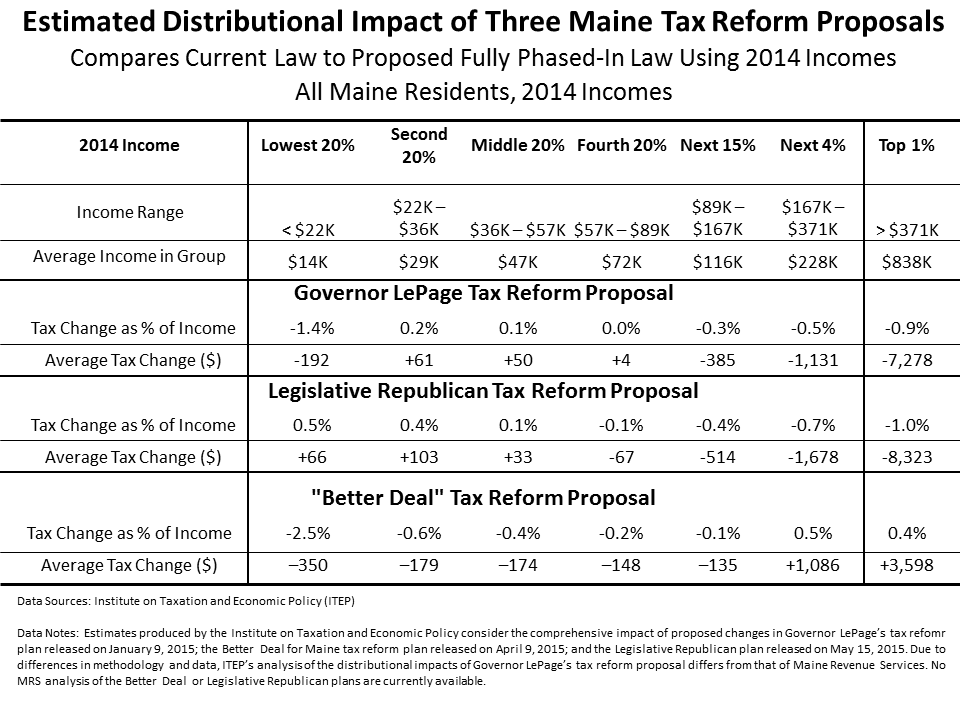

Among the three tax plans, the Republican plan is the worst deal on average for Mainers with an annual income less than $36,000 and the best deal for Mainers with an annual income above $89,000. The governor’s plan is worst for middle-income Mainers with an annual income between $36,000 and $89,000. And the Democrats’ “A Better Deal for Maine” plan is the best deal for the 80% of Mainers with an annual income below $89,000 and the worst deal for Mainers with an annual income above $89,000, even though the Democrats’ plan cuts taxes for Mainers with income between $89,000 and $167,000.

Most striking is that while not as generous as the Democrats’ plan, the governor’s tax cuts actually provide substantial tax relief to low-income Mainers while the Republican plan delivers more benefit to Maine’s wealthiest residents. When it comes to improving the overall fairness of Maine’s tax system, the Republican tax plan does the most harm. Rather than improve tax fairness, the Republican plan actually makes a bad situation even worse.

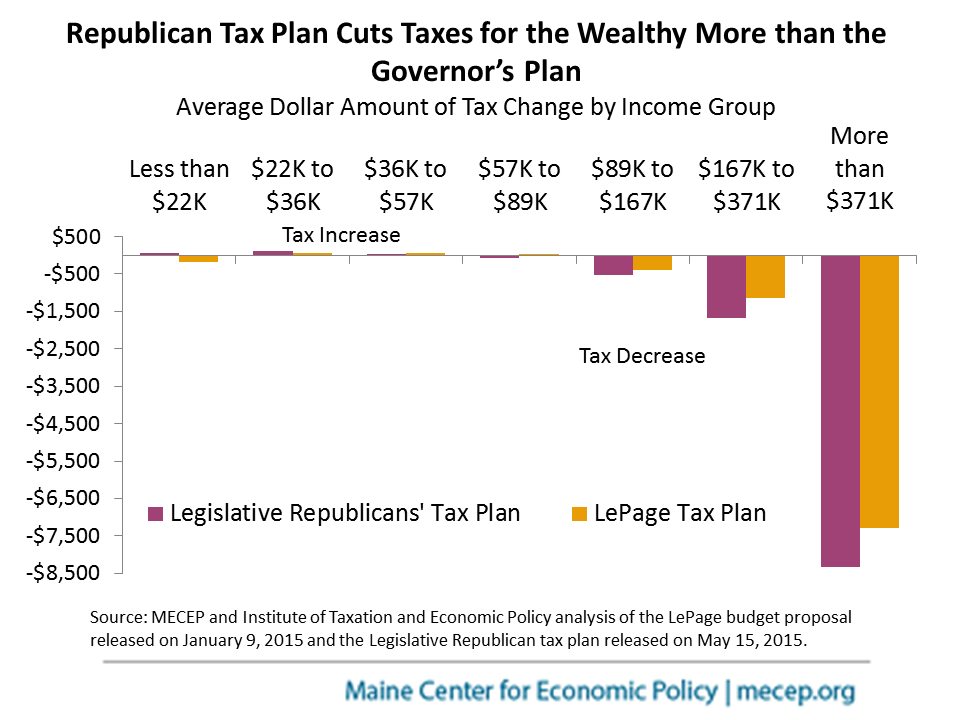

The Republican plan actually raises taxes for, low- and middle-income Mainers, while high-income Mainers get a huge bonus. The chart below compares the average change in taxes contained in the Republican plan and the governor’s plan. More detailed data for all three plans can be found in the table at the end of this post.

Anyone who thinks that the Republican tax plan represents a “middle ground” compromise between the governor’s plan and the Democratic plan is wrong. While more than half of the tax cuts in the governor’s plan would go to Maine families with more than $134,000, in annual income even his plan doesn’t raise taxes on low-income Mainers. The fact that the Republican plan gives away an even greater share of its overall benefits to the wealthy reveals how flawed their strategy is when it comes to improving tax fairness.

Both the governor’s plan and the Republican plan reflect the discredited “trickle down” world view that cutting taxes for people at the top of the income ladder will result in good things for the rest of us-even if we have to pay for their tax cuts with higher sales and property taxes or slashed services.

The legislative Democrats’ plan reflects a different approach, one that prioritizes tax cuts for low- and middle-income Mainers and ensures that future investments in education, healthcare, and other vital services aren’t compromised or shifted to property taxpayers. And by asking the wealthy to pay their fair share and targeting tax cuts to low- and middle-income Mainers, the Democrats’ “A Better Deal for Maine” is the plan that by far does the most to improve tax fairness.