Elected officials’ decisions to weaken our estate tax have perpetuated and exacerbated economic inequality in our state. It has delivered a massive tax break to the very wealthiest households and limited our ability to invest in the things that build economic security for everyone – such as education, reliable public services, health care, and jobs.

Estate tax cuts enacted since 2011 contribute to the unfairness of our tax code. Repairing our broken estate tax is a key element in un-rigging our tax code so that everyone pays their fair share. As elected officials in Augusta are wrapping up this year’s legislative session, they still have a chance to roll back the estate tax cuts enacted under Governor Paul LePage.

Earlier this year, MECEP advocated for a bill to restore the estate tax to pre-LePage levels. While that bill was unfortunately defeated, lawmakers can still approve another, slightly scaled back, version of the estate tax fix. Doing so would raise much-needed revenue to fund investments that increase economic security and make it easier for low- and moderate-income Mainers to start building their own wealth.

What is the estate tax? And how is it broken?

Taxes pay for the things that help all of us thrive, such as schools, roads, reliable public services, and health care. Most taxes come from economic activity — the transfer of cash or goods from one person or organization to another; Income taxes come from the money transferred from employers to workers. Sales taxes come from the exchange of money for goods or services.

The estate tax is no different. It comes from the transfer of property such as cash, real estate, stocks, and other assets from a deceased person to their heirs. Maine’s estate tax rate is progressive, ranging from 8 percent to 12 percent. However, a portion of the estate’s value is exempted from the tax, allowing that wealth to be transferred tax-free.

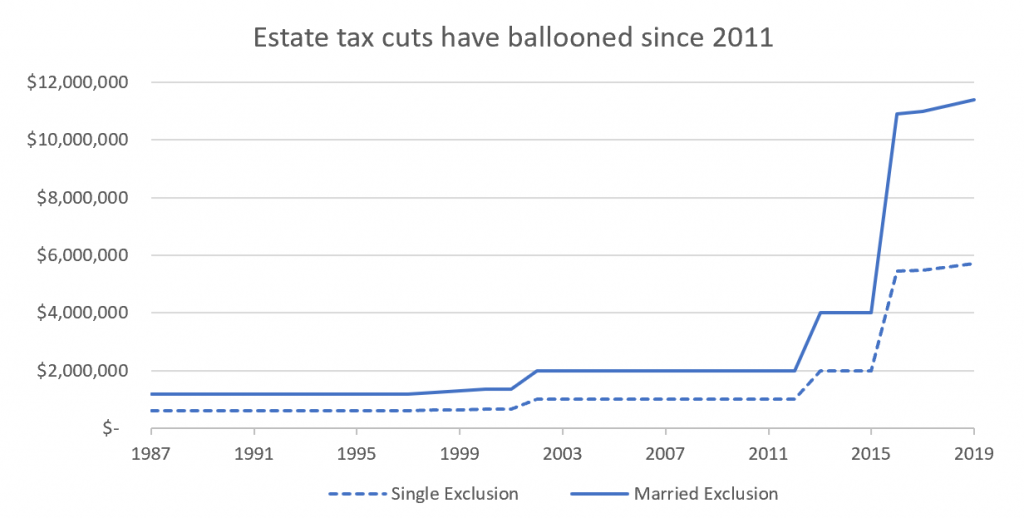

Since 2011, policymakers have made Maine’s estate tax exemption larger and larger, creating a loophole through which the heirs to wealthy estates can accumulate massive wealth without paying taxes. The estate tax exemption today is more than five times larger than it was before Governor Paul LePage took office.

Under the LePage administration, the exemption ballooned from $1 million $5.7 million. For estates of married couples, that amount is doubled, meaning those estates may transfer $11.4 million to heirs without paying any taxes. The ever-growing privilege for the heirs of very large estates to see their wealth grow dramatically without paying taxes is a big reason our tax code is so out of balance.

LD 420 reverses Gov. LePage’s largest estate tax cut

Maine legislators are considering a bill to improve tax fairness and combat economic inequality by strengthening our estate tax. The bill — LD 420, “An Act to Amend the Maine Exclusion Amount in the Estate Tax” – would undo the largest estate tax cut enacted under Governor LePage. It would decrease the estate tax exemption to $2 million for the estates of individuals and $4 million for estates held by married couples, beginning in 2020.

We can estimate that fewer than 200 estates, representing the very wealthiest households in Maine, would be affected by reduced estate tax exemption. That’s according to state tax data from 2015, the last year the estate tax exemption was set at the level proposed by LD 420. Many of those Maine-based estates are held by residents of other states.

Restoring the estate tax would raise an additional $10 million to $20 million annually, depending on how many estates are transferred to heirs, and the size of those estates, in any given year. Passing LD 420 into law would free up an additional 10-20 million each year.

Fixing our estate tax will combat inequality, boost opportunities for low-income Mainers

The estate tax is the most practical tool at the state level to address the historic levels of wealth inequality.

The top 1 percent of Americans hold 40 percent of wealth in the country, up from 25-30 percent in the 1980s. Meanwhile, a growing share of Americans, including nearly half of all Mainers, say cash is so tight that they wouldn’t be able to afford a $400 emergency expense, such as a car repair or hospital bill.

Wealth for the poorest 10% of Americans has actually declined over the past 50 years. Racial disparities in wealth today are as stark as they were in 1963, with white family wealth seven times greater than black family wealth and five times greater than that of Hispanic families.

Fixing Maine’s estate tax will counter inequality by making the wealthiest households in Maine pay their fair share. That money can be put to use funding investments that create economic opportunity, such as good schools and health care, for those families