The Earned Income Tax Credit, or EITC, is a proven tool to reduce poverty and give kids from families with low incomes a better shot at success later in life.1 Maine lawmakers have a chance this year to strengthen the state’s EITC, boosting incomes for 92,000 Maine households.

LD 498 — sponsored by Rep. Mike Sylvester of Portland — would strengthen Maine’s EITC by increasing the credit by four to eight times its current value, depending on family size. That would bring Maine’s EITC in line with the federal credit.

The bill funds this investment in working families with a new 3 percent tax on income above $200,000. The tax would affect only the top 3.6 percent of households.

The EITC is a commonsense tax break for families who work

People who work hard should be able to afford the basics necessary to make ends meet, such as housing, food, health care, and child care. But low-wage jobs often mean families struggle to keep up with basic expenses.

In Maine, 17 percent of households could not afford a $400 emergency.2 Not only do these families not have savings to cover $400, but they also don’t have access to credit for that expense either.

The EITC helps those working families by giving them a larger refund on their federal and state tax returns. Roughly 92,000 Maine households claim the EITC3, though more are eligible.

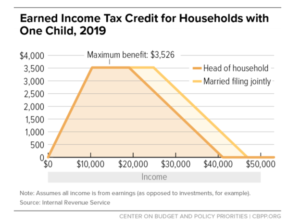

The credit amount increases for each dollar earned and begins to phase out at higher levels of income. As families earn income, the credit amount increases, encouraging work. And as families gain economic security, the credit slowly tapers off. The chart below shows how this works for a one child family.

The EITC has been successful in encouraging and rewarding work, especially for single parents working for low wage jobs who, as primary caregivers, struggle to balance schedules and find affordable childcare.4

Eligible workers receive the EITC twice when they file their taxes: They receive the full federal EITC on their federal tax return. They receive a much smaller credit — worth just 12 percent of the full federal EITC for adults with children and 25 percent for childless adults — on their Maine income tax return.

The EITC expansion in this bill would raise Maine’s current credit to equal the federal EITC. The table below shows how the maximum credit amounts would differ from current law. Maines maximum credit would increase from about $800 for a family with three children to $6,660.

| Maximum Credit | Maximum Earnings | |||

| Current Law | LD 498 | Single | Married | |

| Childless | $134.50 | $538 | $15,820 | $21,710 |

| One Child | $430.08 | $3,584 | $41,756 | $47,646 |

| Two Children | $710.40 | $5,920 | $47,440 | $53,330 |

| Three or More Children | $799.20 | $6,660 | $50,594 | $56,844 |

Note: These amounts are based on the Federal EITC for tax year 2020. Maximum earnings is the earnings level at which a filer no longer receives EITC. Source: IRS, Earned Income and Earned Income Tax Credit (EITC) Tables

Raising taxes on high incomes would help working families, reduce poverty

To pay for the expansion of Maine’s EITC, LD 498 would create a 3 percent tax on all taxable income above $200,000 starting in tax year 2022. The tax would affect the wealthiest 3.6 percent of households and only tax earnings above that threshold.

This policy is nearly revenue-neutral; The 3 percent tax would raise roughly $180 million, and the state EITC expansion would cost $175 million.

Structurally, the income tax is the fairest tax in Maine, with higher-earning households paying a higher rate than those who earn less. But Maine’s current top rate applies to taxable income above roughly $52,000 for single filers and $104,000 for married filers. That means some middle-income workers pay the same top tax rate as a CEO or high-paid lobbyist.

Maine is not alone in this regard, but in recent years some states have added higher income brackets so that the wealthiest households pay a higher top tax rate than middle-income families. Creating a new tax on taxable incomes over $200,000 would help us achieve this in Maine, while affecting only the wealthiest 3.6 percent of families.

Conclusion

By asking a little more of the wealthiest, LD 498 would make a transformational investment in Maine workers and families who struggle to afford the basics. Our entire state will benefit as those families put that cash right back into their local economy — whether at the grocery store, the mechanic, or at daycare.

The bill would boost incomes for at least 92,000 hardworking low- and middle-income families, while helping make Maine’s tax code a little fairer. It offers a smart approach to both anti-poverty and tax policy.

Notes:

[1] Policy Basics: The Earned Income Tax Credit. The Center on Budget and Policy Priorities. Updated December 10, 2019 https://www.cbpp.org/sites/default/files/atoms/files/policybasics-eitc.pdf

[2] Hardship data from US Federal Reserve Survey of Household Economics and Decision making, 2017-2019.

[3] Maine Tax Expenditure Report 2022-2023. Maine Revenue Services. February 15, 2021. https://www.maine.gov/revenue/sites/maine.gov.revenue/files/inline-files/tax_expenditure_21_0.pdf

[4] Center on Budget and Policy Priorities, 2019.