A soldier returns from a tour of duty in Afghanistan to find his car repossessed in his absence. A sailor on patrol in the Persian Gulf receives a notice that the lender is raising the interest rate on her home loan and demands a balloon payment. With all of the pressures our service members face, should they also have to cope with abusive, devious lenders?

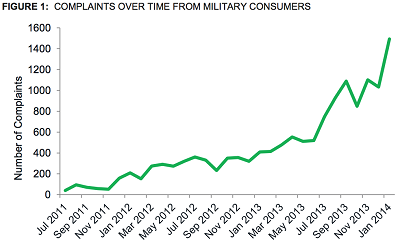

Between July 21st 2011 (when the Consumer Financial Protection Bureau began accepting complaints) through February 1st 2014, the CFPB received approximately 14,100 complaints from military consumers about deceptive practices in the financial services industry, especially debt collection and payday lending. The number of complaints filed by military consumers has grown steadily over time, rising 148% from 2012 to 2013.

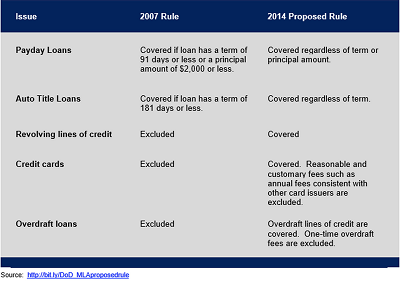

In order to protect our service members from payday lenders, high-cost installment lenders, and other abusive credit providers, the Department of Defense (DoD) has issued a comprehensive new rule pursuant to the Military Lending Act—a 2006 law that capped interest rates and add-on fees lenders may charge to members of the military and their families at 36 percent.

Loopholes in the current rules allow creditors to skirt them putting thousands of military families under financial stress that leads to loss of military clearance or forces some service members out altogether.

According to the Consumer Federation of America (CFA), the updated rule will:

- Apply market-wide to all high-cost credit products that target service members, including payday, auto title, and installment loans designed to evade the 2007 protections;

- Cap interest and add-on fees at 36 percent for loans issued to service members and their dependents;

- Prevent lenders from using junk fees such as credit insurance, debt cancellation, or debt suspension to circumvent the 36 percent interest and fee cap; and

- Preserve service members’ access to the courts by prohibiting forced arbitration agreements.

Our service members and their families make tremendous sacrifices to defend us from harm. They deserve our protection from unscrupulous, predatory, and abusive lenders.