When Maine communities thrive, so do the corporations that do business here. But when profitable corporations build their wealth by exploiting the tax code and hiding their profits to avoid paying taxes, it is workers, small businesses, and our communities — not CEOs or shareholders — who are harmed.

One way that corporations manipulate the tax system to avoid paying their fair share is by sheltering their US-based profits in countries with lower taxes, often referred to as “tax havens.”

This practice is well-documented and costs Maine tens of millions of dollars annually, at a time when our schools and communities lack the resources they need to meet Mainers’ needs.

This year, Maine can take steps to limit tax haven abuse by passing LD 428, “An Act to Prevent Tax Haven Abuse,” sponsored by Rep. Denis Tepler. Lawmakers should enact this legislation to clamp down on tax avoidance schemes by multinational corporations and restore some of the revenue needed to invest in Maine’s communities.

The world’s largest corporations use tax havens to avoid paying their fair share

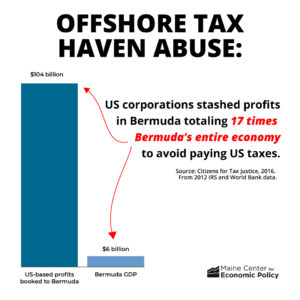

Each year, large US-based companies such as Apple, Pfizer, Exxon Mobil, Google, and others use a complex system of international accounting loopholes to move their domestic profits into tax havens.1 Instead of contributing what they should at home, these corporations book their US-based profits, including those generated here in Maine, to countries with lower tax rates — essentially hiding them from taxation.

Nationally, Fortune 500 companies have moved $2.6 trillion of profit to offshore tax havens. And this international tax avoidance scheme reduces revenue right here in Maine.

National and international businesses with sales in Maine owe state taxes proportionate to the share of their total US-based sales that occurred here. For example, a company that made 50 percent of its US sales in Maine would owe Maine income taxes on 50 percent of their US-based profits.

When businesses exploit the tax haven loophole to lower their US profits on paper, Maine loses out on revenue that should go to our state. Maine loses up to $52 million per year as a result of tax haven abuse.2 LD 428 would help to recoup a significant portion of these lost revenues.

LD 428 brings profits sheltered in tax havens back into Maine’s tax base

This bill would reform Maine’s system of international corporate taxation to bring Maine profits hidden in tax havens out of hiding and into the Maine tax base. This bill would extend Maine’s current method of combined reporting to include profits booked to known tax havens. This would still require businesses to only pay taxes on the share of their profits that equal the share of their sales that happened in Maine.

This bill follows the lead of Montana in putting forward a list of tax havens to be included in calculating their corporate tax base and doing a regular review to update the list of tax haven entities based on changing international law.3

This bill lists the most frequently used tax haven destinations multinational corporations use to hide their profits. The strategy of using tax havens to avoid taxes, and the legal system that support it, started in Switzerland in the 1920s.4 To this day, Switzerland continues to be a major destination for those seeking to hide wealth and corporate profits.

Other European nations including Luxembourg, The Netherlands, and Ireland have put themselves on the map as low-tax destinations for multinational corporations and are home to thriving financial service industries set up to hide wealth and profits generated in other countries. It is important that tax haven legislation includes wealthy European tax havens as well as poorer countries, such as Bermuda and the Cayman Islands, that do not have the taxing infrastructure of wealthier countries.

Clamping down on tax haven abuse will make our tax code fairer

Taxes are how all of us — individuals, families, small businesses, and giant corporations — come together to fund the investments that create thriving communities and a strong economy for everyone. The tax havens loophole is just one example of how wealthy, powerful special interests can manipulate the tax code to get out of paying their fair share.

LD 428 is a powerful step to clamp down on tax avoidance by profitable, multinational corporations, improve fairness in our tax code, and restore the revenue Maine needs to invest in our future.

Notes:

[1] Institute on Taxation and Economic Policy. “Fortune 500 Companies Hold a Record $2.6 Trillion Offshore: These Companies Are Avoiding $767 Billion in U.S. Taxes.” March 2017. https://itep.org/fortune-500-companies-hold-a-record26-trillion-offshore/

[2] Phillips, Richard and Nathan Proctor. “A Simple Fix for a $17 Billion Loophole: How States Can Reclaim Revenue Lost to Tax Havens” Institute on Taxation and Economic Policy and U.S. PIRG Education Fund. January 17, 2019. https://itep.org/a-simple-fix-for-a-17-billion-loophole/

[3] Montana Department of Revenue. “Corporate Income Tax Water’s Edge Election—Tax Haven Country Update” June 25, 2018 https://leg.mt.gov/content/Publications/Services/2019-agency-reports/dor-tax-haven-update.pdf

[4] Gabriel Zucman. “The desperate inequality behind global tax dodging.” The Guardian. November 8, 2017. https://gabriel-zucman.eu/global-tax-dodging/