House and Senate Republicans expect to vote on their tax bill early this week after an agreement on its provisions was struck Friday. The deal lowers the top individual rate to 37 percent, lower than either House or Senate versions of the bill, and pegs a new flat corporate tax rate of 21 percent.

The deal, if passed by Congress and signed by President Trump, will ultimately increase taxes on the bottom 80 percent of Mainers, while delivering huge tax cuts to profitable corporations, wealthy foreign investors and the richest Americans.

The bill makes significant changes to individual, corporate and estate tax rules tilted in favor of those already prospering. The tax bill is expected to add more than $1.4 trillion to the national deficit, increase taxes on many low and middle-income Mainers and trigger deep cuts to education, affordable health care and emergency food assistance.

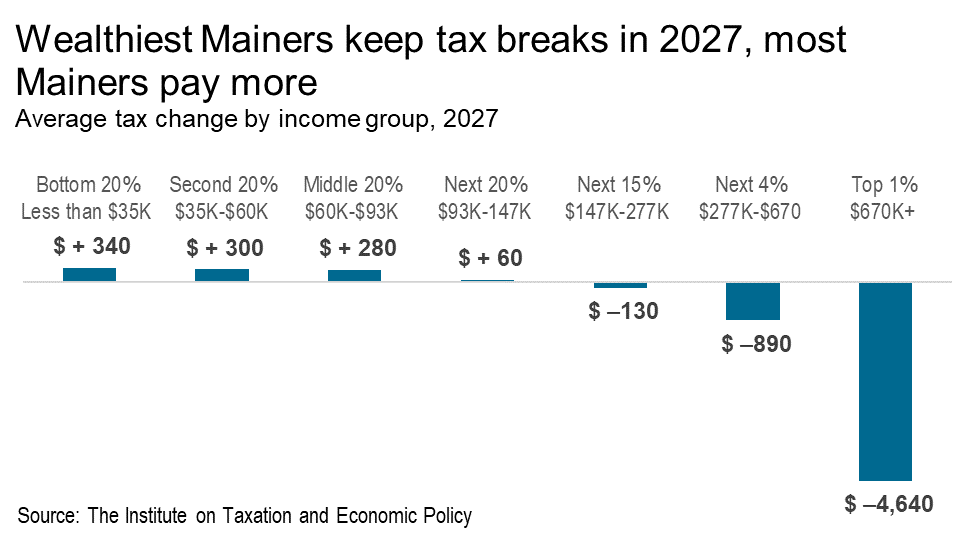

The bill features a misleading bait-and-switch, whereby temporary tax cuts for working families evaporate over time, while tax cuts for big corporations remain in place permanently. The bill also delivers a tax break to wealthy foreign investors that’s nearly double the benefit that the middle 20 percent of American families receive.

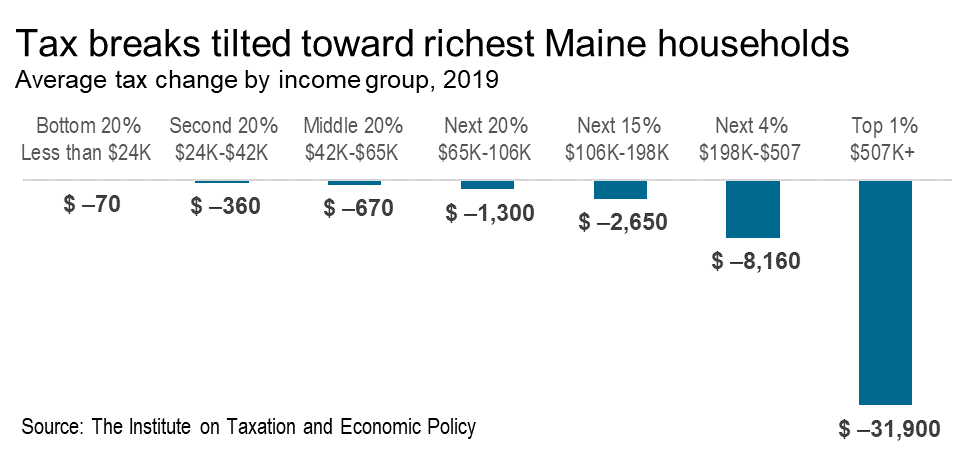

In 2019, the plan is already heavily tilted toward the richest Maine households. The top 1 percent of Mainers are slated to receive a tax break of $31,900, while middle-income households making between $42,000 and $65,000 will receive only $670 on average.

By 2027, the tax plan skews even more heavily in favor of the rich: The 80 percent of Mainers earning less than $147,000 a year can expect to see their taxes increase on average, while the wealthiest Mainers would still receive significant tax breaks. In total, Maine families will pay $88 million more in federal taxes in 2027 if the current agreement becomes law.

The tax bill has a cost of more than $1.4 trillion. The ensuing revenue shortfall will leave Congress scrambling to balance the budget, with top Republican lawmakers already promising spending cuts targeted at families and seniors. GOP House Speaker Paul Ryan recently said that once the tax bill is passed, he will turn to cutting successful programs that help families afford food, housing, health care and other basic needs.

Ultimately, Mainers will pay more in total federal taxes under this plan. Taken in tandem, the tax package and promised cuts to anti-poverty programs will unravel the services and protections that build and strengthen the middle class in order to enrich already wealthy corporations and individuals.

The true costs of this tax plan remain to be seen as the costs of weakened protections and services for families at the federal level are likely to show up in the form of higher costs at the state and local level as local governments attempt to fill the gaps created by federal cuts. Maine families could see even greater tax increases at the state and local level if the Republican tax plan passes.

To learn more about the tax plans state and national impacts, visit the Institute on Taxation and Economic Policy’s report here.