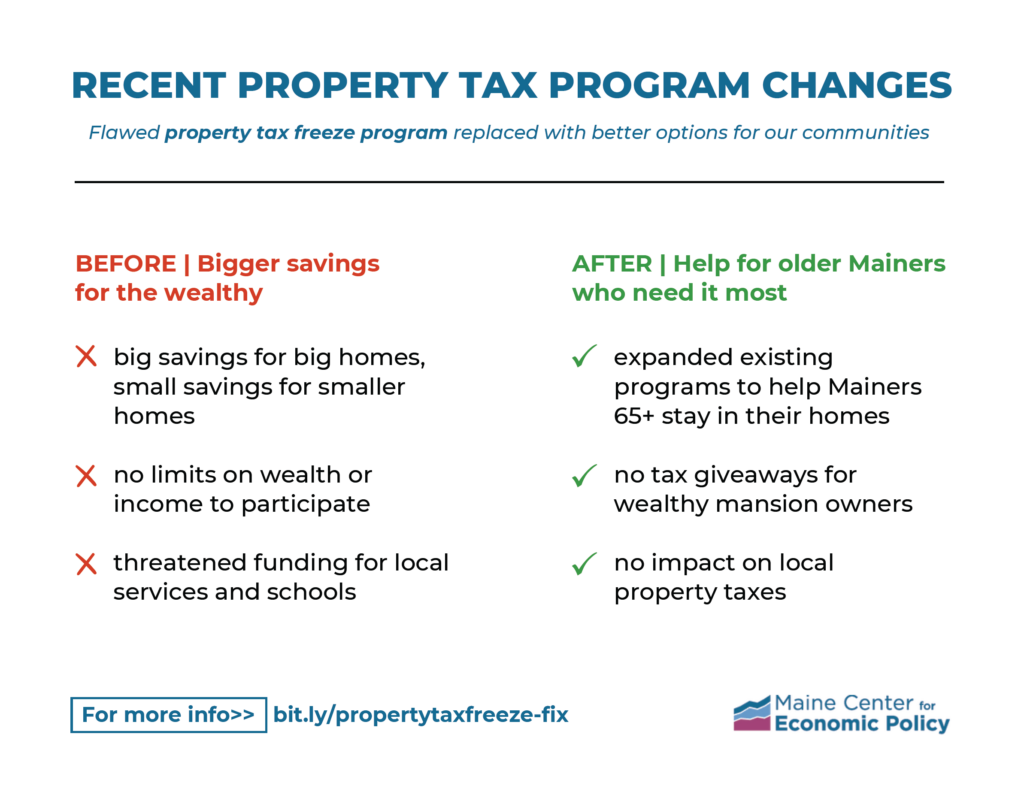

Update: The proposed changes to the property tax freeze program described here were enacted in July 2023 as part of the state budget, LD 258 part S. Click the image below for a printable handout summarizing the changes.

Maine’s property tax freeze program, also known as the property tax stabilization program, was put in place hastily at the end of last legislative session despite serious concerns expressed by the legislature’s Taxation Committee that went unaddressed. The program is poorly targeted to help housing insecure older Mainers stay in their homes, disproportionately benefiting property rich Mainers while people with less valuable property see a much smaller benefit.

Scenarios of actual homes approved for the property tax freeze program1 illustrate how benefits will increase as property taxes increase, resulting in property owners with high home values accruing greater benefits faster than homeowners with lower property values.

- A $1.9m house has $26,304 in property taxes this year, with $23,529 in taxes last year (one-year property tax savings = $2,775)

- A $240k house has $2,937 in property taxes this year, with $2,625 in taxes last year (one-year property tax savings = $312)

The Taxation Committee has proposed sunsetting the property tax freeze program after the current tax year and redirecting its funding to two targeted initiatives — expanding the existing property tax fairness credit and property tax deferral program, which are targeted by income level — that help reduce the cost of property taxes for older Mainers with the greatest need.

Property tax fairness credit

Advantages

- Limited to households with low and middle income. People most in need get help and state resources aren’t wasted subsidizing property taxes for the wealthy, unlike the property tax freeze where recipients qualify regardless of income, which means greater benefits for homeowners with higher property taxes and more valuable homes.

- Recipients accrue benefits in the same year they’re facing hardship with costs. Conversely, by locking in existing property tax rates, the freeze does little to help people who are struggling now — including older Mainers most at risk of losing their housing — and could take years to turn into meaningful tax reduction.

- Gives older Mainers the flexibility to determine the living situation that works for them. Both homeowners and renters can participate and there’s no requirement to own property for 10 years to benefit, as there is under the property tax freeze.

- Cost and administration of the property tax fairness credit program are fully covered by the state. This eliminates the risk that costs will not be fully reimbursed to municipalities and simplifying the process for receiving benefits. In contrast, municipalities said implementing the property tax freeze has been a huge administrative burden and worried the state would not be able to meet the ballooning program costs.

Proposed changes

- Increasing in the maximum credit for Mainers 65 and older from $1,500 to $2,000

- Providing the same benefit regardless of household size, covering older Mainers if their household size decreases

- Expanding income eligibility so more Mainers with middle income will benefit

Property tax deferral program

Advantages

- Allows homeowners to defer property tax payments until they sell their property or until it transfers to their estate

- Allows concurrent participation in the property tax fairness credit to lower property taxes owed later by the estate

- Allows the state to recoup the cost of lost property taxes later from the homeowner’s estate, meaning ultimately the program does not have a significant cost to Maine taxpayers

Proposed changes

- Allowing homeowners in arrears on property taxes by up to 18 months to participate in the program, which will help people who have already fallen behind on property tax payments and are most at risk of losing their housing

- Increasing the maximum allowable income (from $40,000 to $80,000) and asset limits (from $50,000 to $100,000) for program participation

Investing more funds in the property tax fairness credit and property tax deferral program is a more targeted, effective way to provide support for housing insecure Maine seniors than continuing the property tax freeze program. Maine Center for Economic Policy applauds the Taxation Committee for putting forward this bipartisan compromise to help ensure housing insecure older Mainers stay in their homes while targeting taxpayer dollars in a fairer and more effective way.

Comparison of existing programs and benefits2,3,4

Notes:

[1] Information from the Freeport property tax assessor’s database and the Town of Freeport, freeportmaine.com. Property taxes will be frozen at this year’s rates. The town tax rate in this example increased from 12.21 in 2021 to 13.65 in 2022.

[3] https://www.maine.gov/revenue/taxes/tax-relief-credits-programs/income-tax-credits/property-tax-fairness-credit