Two years ago, today, the US Senate enacted the “Tax Cuts and Jobs Act,” or TCJA, known more commonly as the Trump Tax Cuts.

The $1.9 trillion legislation dramatically reshaped our tax code in favor of the wealthiest households and corporations. In the two years since its enactment, it has delivered promised windfalls to the wealthy and powerful. In doing so, it is exacerbating racial inequality, while benefits for the economy promised by its supporters have failed to materialize.

TCJA corporate tax cuts deliver windfalls to the wealthiest

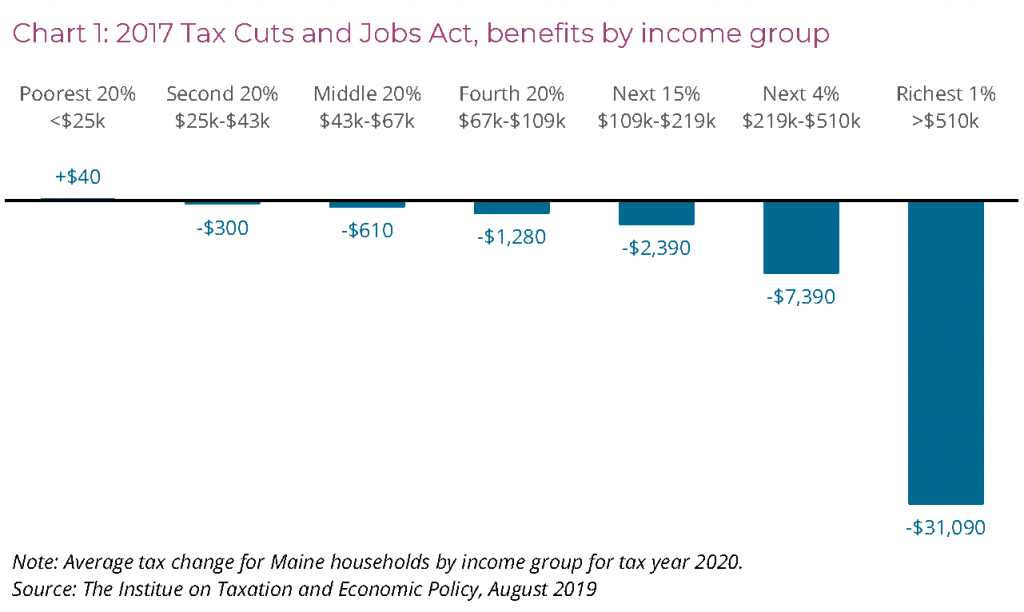

The TCJA amounts to a huge raise for the wealthiest Mainers. In 2020, the top 1 percent of Maine households — those with incomes over $520,000 — will receive an average tax cut of $31,090. As a result of the TCJA’s repeal of the individual health insurance coverage mandate, the poorest 20 percent of Mainers will see a $40 federal income tax increase next year.

Much of the TCJA’s benefit to the wealthiest Americans comes from one of the law’s signature features — a reduction in the corporate income tax rate from 35 percent to 21 percent and new tax loopholes for corporations. The tax cuts to corporations were so massive that 91 of the Fortune 500 corporations paid zero income tax in 2018.

These corporate giveaways are ultimately funneled to the wealthiest households, which own most of the shares in large, profitable companies. The wealthiest 20 percent of American households will reap 81 percent of the corporate tax cut in 2020, with the top 1 percent poised to receive 44 percent of the total corporate benefit from TCJA, according to an analysis by the Institute on Taxation and Economic Policy.

Some low- and middle-income households will receive a tax cut as a result of the TCJA in 2020. But the personal income tax cuts that those families receive will expire in 2025, while the majority of corporate tax cuts that benefit the wealthy will remain.

TCJA exacerbates racial inequality

Wealth in the United States is held primarily by white people, who disproportionately have higher incomes than people of color. The TCJA is exacerbating racial inequality by increasing after-tax income for white households more than for Black and Latinx families.

White households represent 67 percent of all households but claim 79 percent of the TCJA’s tax cuts. To a smaller degree, Asian families also claim a disproportionately large share of the benefits, representing 4 percent of households and 6 percent of the TCJA’s tax cuts.

Meanwhile, Black and Latinx families — who represent 10 and 12 percent of households, respectively — receive only 5 and 7 percent of the TCJA’s benefits.

Tax cuts have not sparked new investments in the economy

Corporations lobbied hard for the TCJA, arguing that the tax cuts would allow them to make new investments that would boost economic activity and create jobs.

Early indicators of business investment showed that investment trends were unchanged by the TCJA and in some instances were under-performing.

Businesses make investment decisions based on aggregate demand for their products. New investments or additional hiring is profitable only if it’s necessary to meet growing demand. The extra cash on hand from tax cuts doesn’t incentivize a business to make unnecessary investments.

To the extent that tax cuts can boost the economy, it’s through increasing consumer demand and spending. And an International Monetary Fund working paper did indicate a modest increase in investment, but attributed those increases to additional consumer demand from the personal income tax cuts in TCJA and stimulus spending in 2018.

While it’s possible to spark investment by increasing the purchasing power of low- and moderate-income households whose spending is constrained by their income, the TCJA isn’t designed to do it. The law will give only 15 percent of its 2020 benefits to the bottom 60 percent of households. For that reason, the TCJA will continue to come short of boosting the economy in any meaningful way and does so at a cost that will imperil future economic activity.