Our economy does better when working people can afford the basics. One tool that helps is the Earned Income Tax Credit, a tax break for low- and moderate-income Mainers who work. Eligible Mainers can claim the EITC on both their state and federal income tax forms and can receive hundreds or even thousands of dollars just by filing their taxes.

For families with very low wages, the credit increases with each dollar earned, which encourages them to work more hours. That additional experience in the workforce can lead to higher pay and better opportunities. The tax credit phases out after recipients reach a modest income level.

The EITC boosts incomes for working families

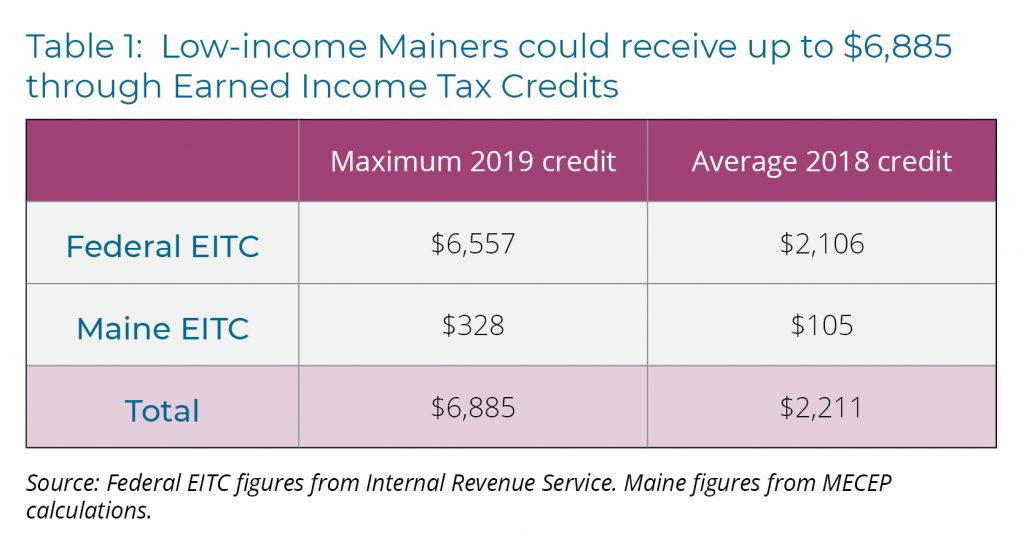

Mainers who worked last year and earned less than $56,000 may be eligible for the federal EITC. Eligible filers could receive a credit worth up to $6,557 on the federal tax return, though the value of the credit varies based on income and by whether the filer has children, and how many.[1] Because the credit is refundable, it translates into larger tax refunds for eligible filers. Those with the lowest income could even receive the full value of the credit in their refund check.

Maine also offers an EITC on filers’ state income taxes. For income earned in 2019, Maine’s EITC is worth 5 percent of the tax filer’s federal credit. Households who receive the maximum federal EITC would receive a $328 credit on their Maine income tax filing.

According to IRS data, 95,000 Mainers working in 2018 claimed a total of $199 million in federal EITC last year. The average credit was $2,106 per tax filer. This state refundable credit boosts Maine incomes by an additional $10 million and will provide an average benefit of about $105 for eligible Mainers

The more people file their taxes, the more the EITC improves our economy and kids’ futures

The credit encourages and rewards work while increasing incomes and economic security for millions of families across the country. Research shows that the majority of recipients use their refunds to pay down debts, pay bills, and build savings. The additional funds for low-income families also can improve health, education, and economic outcomes for kids.

But more is being left on the table. About 1 in 5 eligible EITC households in Maine does not claim the federal credit and roughly $33 million in unclaimed credits are being left on the table. Of those Mainers who do claim the federal credit, 7 percent don’t claim the state credit for which they are eligible, according to administrative data.

The EITC will be even better next year

Maine’s Legislature in 2019 enacted a bill to improve Maine’s EITC, which will provide even greater benefits Maine families starting next tax season. The law more than doubled the credit for Maine families and passed an additional boost for working Mainers without kids, for whom the federal EITC is far too small.

These changes, along with some property tax fairness expansions, mean for the first time in decades the bottom 40 percent of households will no longer pay more of their income to state and local taxes than the top 1 percent.

The availability of the EITC is one major reason that low- and moderate-income families should make sure to file their taxes. If they don’t, they could be leaving thousands of dollars on the table.

Endnotes:

[1] Working families with children and incomes up to $55,952 may claim a maximum credit of up to $6,557, depending on the number of children in their household. Eligible filers without children and incomes below $21,370 are eligible for a smaller credit of up to $529 if they were 25 years old or older at the end of 2019. For more information and to check your own eligibility, check out this tool from the Center on Budget and Policy Priorities.