Communities in every corner of the state have suffered from underfunding of education and local services. The symptoms of cuts to communities are greater pressure on town budgets, cuts to local services and schools, and property tax increases. Some communities have responded by pushing the state Legislature to authorize a local option sales tax. The Legislature is currently considering five such bills.

Insufficient revenue to fund those things that make our communities great places to live is a statewide problem. It deserves a statewide solution. The local options sales tax is not the answer. Raising revenue at the state level to fund local schools and services is a fairer and more comprehensive solution to the revenue needs of Maine communities.

A local option sales tax could raise significant revenue for some service centers and for communities heavily reliant on the tourism industry. However, its implementation in those communities would disproportionately affect lower-income Mainers. It would deepen economic inequality by tipping our already lopsided tax code even further out of balance.

Local option sales taxes are a tool that would empower some communities while doing little — or even nothing — for others. The taxes are feasible for those municipalities with enough commerce to raise meaningful revenue, but not for those without such a sales base.

To illustrate this point: The ten municipalities with the highest meals and lodging sales in the state generate 45 percent of the state’s meals and lodging tax revenues. But those same ten municipalities are home to just 16 percent of the population. Similarly, the ten municipalities with the highest total taxable sales in our state generate 42 percent of all sales tax revenue but represent only 19 percent of the state’s population.[1]

By creating a new system of haves and have-nots, the local option sales tax would create even greater division between communities with means and those without. It would also be inadequate to meet our municipalities’ needs. Even in the unlikely scenario where every town voted to approve a 1 percent general sales tax, they would only raise $435 million over the coming two-year budget cycle.[2] Fully funding schools and communities on the other hand would send an additional $520 million more to towns over the same timeframe.[3]

We see full funding of revenue sharing and schools as a fairer alternative to ensure communities are getting the support needed to provide high-quality services and limit pressure on property taxes.

We are particularly concerned about LDs 65, 156, and 1110, which would allow communities to create a general local option sales tax. For towns looking for an alternative to property tax increases, a general sales tax is a poor choice.

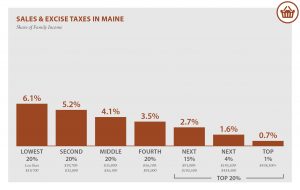

Both taxes hit those who can earn the least more than those who earn the most. But in real terms, the sales tax affects poorer Mainers far more than the property tax. The poorest 20 percent of Mainers pay an effective sales tax rate that’s 8.7 times higher than the top 1 percent of Mainers. Those same low-income families pay an effective property tax rate that’s 1.8 times higher than the richest 1 percent.[4]

Although a portion of a local option sales tax would be paid by tourists and residents of nearby communities, residents of the implementing municipalities would pay the tax most often and those residents with the lowest incomes would be hit the hardest.

While all sales taxes are regressive, statewide increases to less regressive sales taxes like meals and lodging taxes can be part of a solution to raising necessary revenue for our communities, but only if they are paired with progressive tax reforms such as rate increases for the wealthiest and profitable corporations and expanded income tax credits for low- and middle-income earners.

That balancing act is only feasible and prudent at the state level. The state already has some programs to offset high property taxes for low-income residents, but the burden of local sales taxes would be much harder to offset because they are more difficult to track.

Rather than have different tax mixes across the state, lawmakers should consider less regressive statewide sales taxes, such as meals and lodging, as part of a larger comprehensive revenue strategy. In doing so, they could fully fund the state’s key priorities, alleviate pressure on property taxes, and create a fairer state and local tax system overall.

There’s no question that communities across the state are struggling to provide services and keep property taxes low. However, a local option sales tax would worsen inequality within and between communities. A comprehensive statewide solution to our revenue challenges, one that fully funds revenue sharing and schools, is the best way to ensure residents across the state have access to high-quality services.

Notes:

[1] Maine Revenue Services, Annual Taxable Sales by Town 2018

[2] MECEP analysis of Maine Revenue Services, Annual Taxable Sales by Town 2018. Total taxable sales adjusted for fiscal year and for inflation using the revenue forecast estimates for sales tax revenues for the 2020-2021 biennium.

[3] This is the difference of full revenue sharing funding at 5% and school funding at 55% compared to the 2019 baseline.

[4] Institute on Taxation and Economic Policy, Who Pays 6th Edition analysis for Maine. Available at: https://itep.org/whopays/maine/