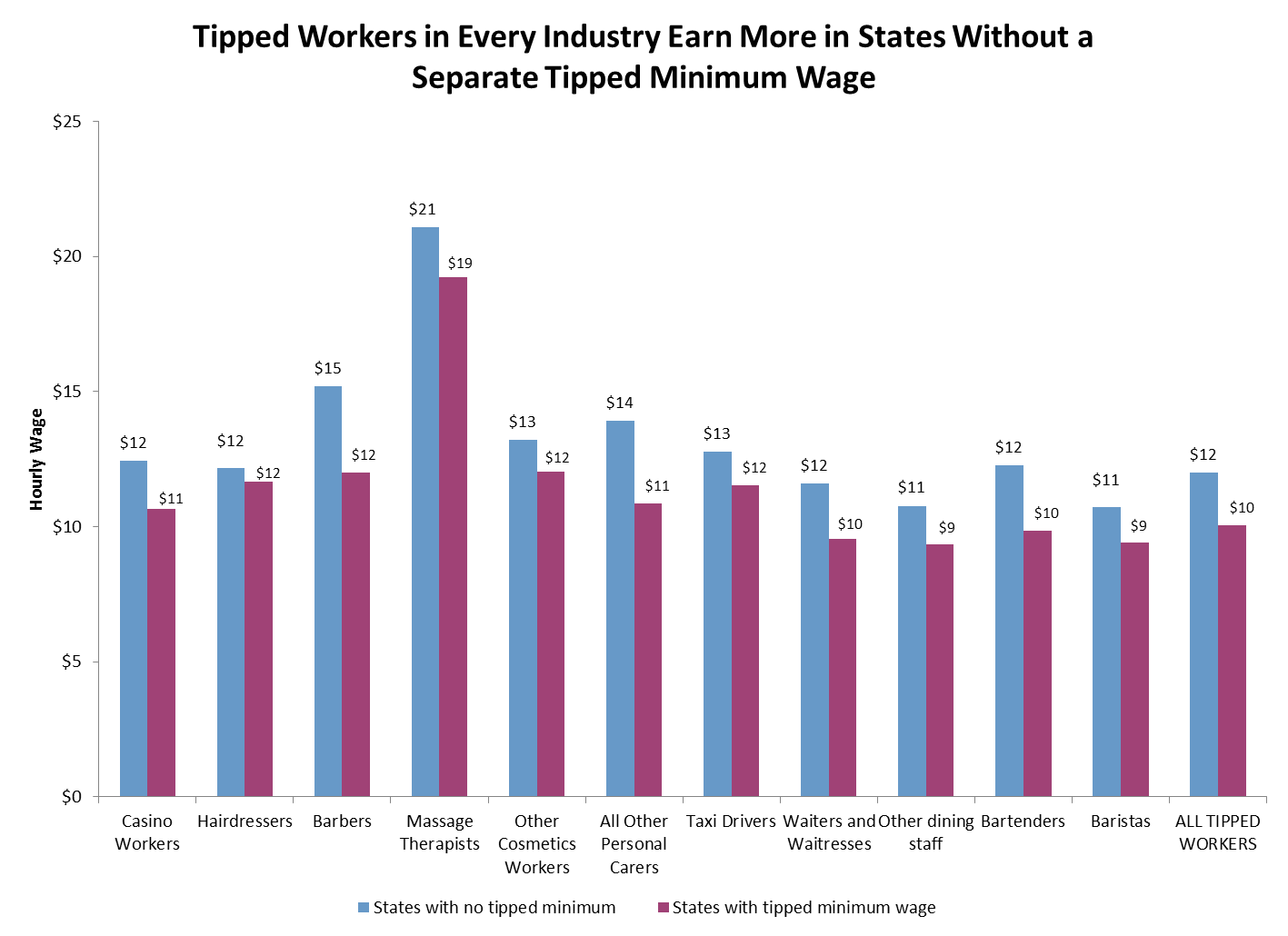

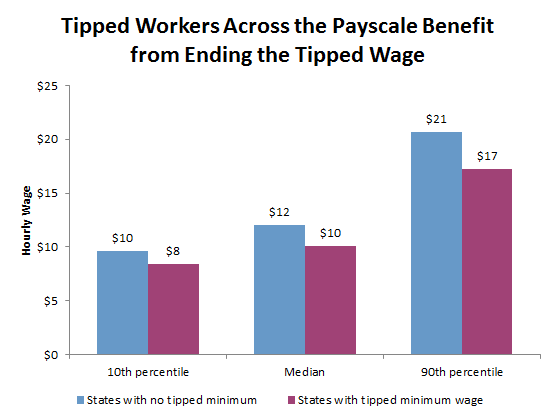

Seven states have already removed the special exemption from minimum wages known as the “tip credit” (Alaska, California, Michigan, Minnesota, Nevada, Oregon, Washington). Federal Earnings data show that tipped workers in these states, on average, earn more from a combination of tips and employer wages that tipped workers in the rest of the country. This is true across each of the eleven different occupation groups in which workers rely on tips, and it is true for workers throughout the income spectrum.

Testimony in Opposition to LDs LD 673: “An Act to Restore the Tip Credit to Maine’s Minimum Wage Law;” LD 702: “An Act To Restore the Tip Credit to Maine Employees;” LD 831: “An Act To Base the Minimum Wage on a New England State Average and To Restore the Tip Credit;” and LD 1005: “An Act Regarding Minimum Wage Increases”

Good afternoon, Senator Volk, Representative Fecteau, and members of the Joint Committee on Labor, Commerce, Research, and Economic Development. My name is James Myall; I am a policy analyst at the Maine Center for Economic Policy, and I am here to testify in opposition to LDs 673, 702, 831, and 1005, and against all proposed changes to the current law phasing out the tipped credit. If there’s one thing most people we’ve heard from today agree on is that we want to do the best thing for the 20,000 Mainers who earn a living through tips. The preponderance of evidence in the academic literature, and the available data show that each of the proposals to maintain a tip credit will harm those same workers.

As we have heard several times today, it’s important to base legislation on facts and evidence. I hope to be able to offer that economic data for you today.

Seven states have already removed the special exemption from minimum wages known as the “tip credit” (Alaska, California, Michigan, Minnesota, Nevada, Oregon, Washington). Federal Earnings data show that tipped workers in these states, on average, earn more from a combination of tips and employer wages that tipped workers in the rest of the country. This is true across each of the eleven different occupation groups in which workers rely on tips, and it is true for workers throughout the income spectrum (see figs.1, 2).[i]

Increasing the wage for tipped workers doesn’t mean an end to tipping. Recent analyses by two card payment service providers, Square and Simple, of the millions of transactions conducted by their customers, revealed the size and frequency of tipping across the United States. Both studies found that the average tips left by customers in the seven states with no tipped wage were the same size as in the rest of the country (16%).[ii] Those same data show that the average tip left in Canada, which also has no tip credit, is the same, 16%.[iii] Square’s data also showed that customers left tips at least as often (57%) for servers in the states without a tipped minimum wage. If tipping rates remain the same, even as base wages increase, those working for tips are better off.

There’s also no evidence to show that a higher minimum wage for tipped workers would lead to a significant reduction in employment. No less than the National Restaurant Association’s own report predicts 11% job growth in the restaurant industry over the next decade in those states without a separate tipped wage for servers. Washington State, where the tipped wage is $11 an hour, will see 12% job growth. In California, where the tipped wage is $10.50 an hour, job growth is predicted to be 11%.[iv] Higher wages for servers are not holding back employment growth in these states.

You have heard today that many servers earn far above the minimum wage. The data also do not support that. In 2016, half of Maine waiters and waitresses worked for an effective hourly rate of $9.38, within spitting distance of the minimum wage ($7.50 in 2016).[v] I know you have heard from some critics of Bureau of Labor statistics data today, so I will add data that comes from the payroll tax returns of more than 4,000 servers. This data, reported by the restaurant owners and managers themselves, showed that nationwide, the average hourly wage – including tips – for a server is $7.42, just barely above the state minimum wage for those servers (which averaged $6.43 over the 2005-11 period of the study). That modest hourly wage is shared between $3.19/hour in tips and $4.44/hr from the employer. Again, this is the legal data reported from the employers to the federal government.[vi] To portray all – or even the majority – of the 20,000 Mainers who rely on tips for a living as somehow well-off is a distortion and only encourages the instances of low tipping that concerns many of the people who testified today.

It is understandable workers who rely on tips would be worried about losing that vital source of income. But the truth is that the data and academic literature tell a different story. I urge the committee not to act from uncertainty or concern, but from the facts and the evidence before you. Evidence from the federal government, employee pay records and payment service providers are all in agreement that tipped workers earnings are not reduced by a reduction in the tipped credit. Reinstating the tip credit will not help servers or other tipped employees.

Thank you, and I’ll be happy to take any questions.

Figure 1. Source: MECEP analysis of US Bureau of Labor Statistics, Occupational Employment Survey, May 2016 data. Median hourly wages are weighted for the employment size of tipped-wage sectors in each state.

Figure 2. Source: MECEP analysis of US Bureau of Labor Statistics, Occupational Employment Survey, May 2016 data. Hourly wages are weighted for the employment size of tipped-wage sectors in each state.

[ii] http://blog.mecep.org/2017/04/a-higher-minimum-wage-is-good-for-tipped-workers/

[iii] https://squareup.com/ca/townsquare/tipping-across-canada

[iv] http://www.restaurant.org/News-Research/Research/Facts-at-a-Glance/State-Statistics

[v] https://www.bls.gov/oes/current/oes_me.htm

[vi] https://www.census.gov/content/dam/Census/library/working-papers/2016/adrm/carra-wp-2016-03.pdf

[pdf-embedder url=”https://www.mecep.org/wp-content/uploads/2017/04/MinWageTestimony_tipped-credit.pdf” title=”MinWageTestimony_tipped credit”]