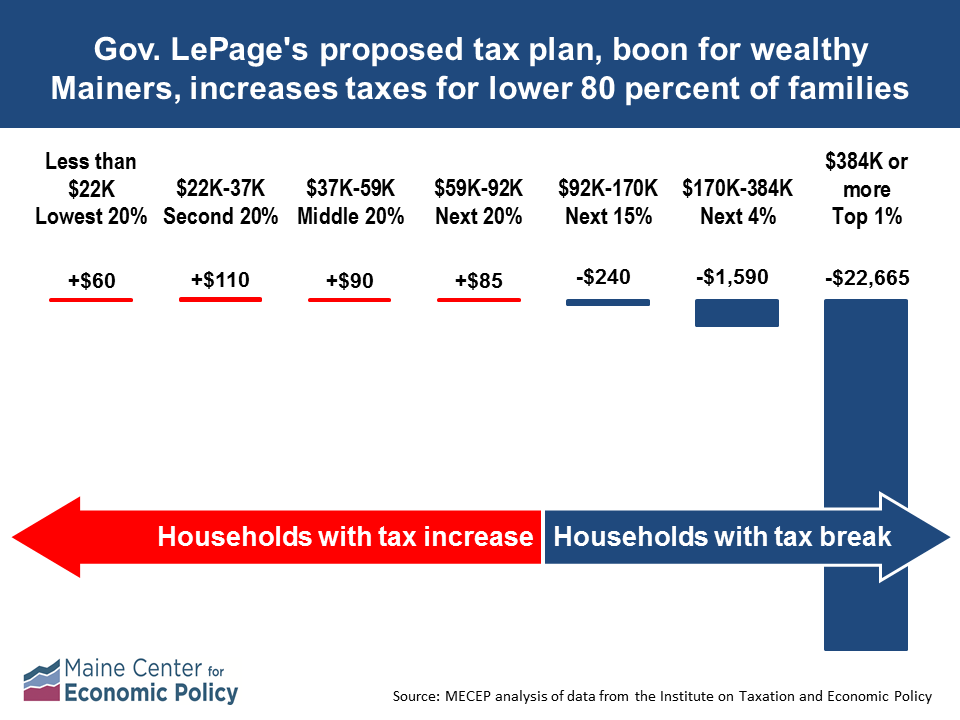

Governor’s Upside Down Tax Plan Will Raise Taxes on 80% of Maine FamiliesAugusta, Maine (Friday, January 13, 2017) The Maine Center for Economic Policy (MECEP) issues new analysis of the distributional impacts of Governor Paul LePage’s budget proposal. MECEP finds that Governor LePage’s budget proposal includes an upside down tax plan that will lead to the following outcomes:

A more detailed summary of the distributional consequences of the governor’s budget follows below. In light of these findings, MECEP Executive Director Garrett Martin issued the following statement: “At a time when Maine families are falling out of the middle-class, when experienced workers need new skills to secure good paying jobs in a modern economy, and when state infrastructure is in need of improvement and expansion, it is unfortunate that Governor LePage continues to prioritize tax breaks for the wealthy and large corporations that are paid for by stripping funding from our schools, shifting more costs onto Maine communities, and increasing taxes on low- and middle-income Mainers. “When fully phased in, the governor’s tax plan increases taxes for households with income below $92,000 and gives a $22,665 tax cut to households with income over $384,000. The tax proposal further reduces state resources by eliminating the estate tax and cutting the corporate income tax which benefits the wealthy and powerful. “Lawmakers should reject the governor’s budget and instead build a plan that strengthens the economic foundations of a prosperous future for all Mainers, not just those at the top.” Detail of MECEP Analysis of Governor LePage’s Budget Proposal

These findings are based on MECEP’s analysis of data from the Institute on Taxation and Economic Policy and account for income and sales tax changes contained in the governor’s budget as well as changes to the homestead exemption, property tax fairness credit, and child care credit. The findings do not account for changes to the corporate income tax or estate tax, which will give greater tax benefits to those at the top. They also do not account for future increases in property taxes that may result from cost shifting from the state to towns and municipalities associated with the governor’s budget proposal that will mainly hurt low- and middle-income taxpayers. Note: Due to differences in methodology and data, MECEP and ITEP’s data for distributional impacts may differ from final figures provided by Maine Revenue Services. More detailed information about ITEP’s microsimulation model can be found here. |

One Weston Court, Suite 103

PO Box 437

Augusta, Maine 04332

207.622.7381 | info@mecep.org

Copyright 2020 Maine Center for Economic Policy

Privacy Policy Fair Use Notice