Summary:

Click here to read this complete policy brief

For years, Maine has fallen short on its commitments to fund public schools and make robust investments in our local communities. This year, legislators can meet both funding targets for the first time ever.

To do so, they must rebuild state revenues lost to income tax cuts enacted under former Governor Paul LePage. Those tax cuts primarily benefit the wealthiest Maine households, and will cost the state more than $860 million this budget cycle.

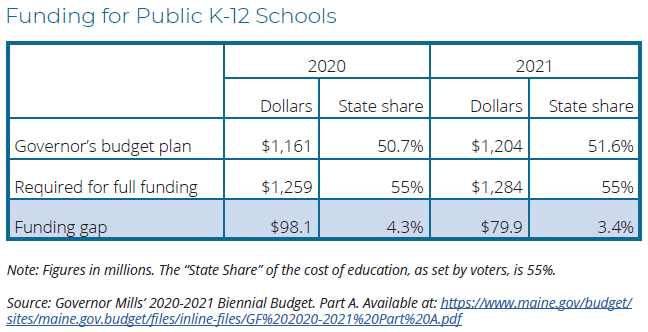

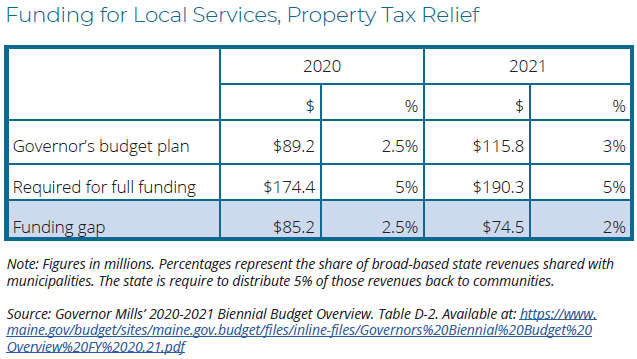

In her budget proposal, Governor Janet Mills keeps those tax cuts, a decision that fuels ongoing shortfalls. Without recouping any of the revenue lost to tax cuts, the proposal is unable to fully fund Maine’s schools, towns, and cities. (See tables below).

Continued shortfalls that put our students, teachers, and communities further behind are not inevitable. This budget cycle lawmakers have a choice: They can continue funding wasteful LePage-era tax cuts that benefit the wealthiest or they can fix our tax code so we can invest that money in things that support thriving communities and a strong economy.

The full policy brief can be found here.