“The earned income tax credit (EITC) reduces poverty, promotes work, and, for children in low-income working families, it increases lifetime earnings. Unfortunately, Maine’s version of the credit is much too small to be effective and is not refundable (the value of the credit cannot exceed a family’s tax liability). Only 20,000 Maine families received an average state credit of approximately $55 in 2013. To reduce poverty and make work pay for Maine’s low-income families, especially those with children, state policymakers should increase the size of Maine’s EITC and make it refundable.”

For a PDF of the report, click here.

By Joel Johnson

Introduction

The earned income tax credit (EITC) reduces poverty, promotes work, and, for children in low-income working families, it increases lifetime earnings.

The federal version of the credit provides substantial support for low-income working families in Maine. 102,000 Maine families, most with children, receive a total of $207 million through the federal credit, which is refundable (i.e., taxpayers who owe no taxes still receive a refund). These credits help Maine’s working families pay for life’s necessities like child care, health care, groceries, housing, and transportation. They help offset payroll taxes, property taxes, and sales taxes, all of which hit low-income households harder than they do high-income households. Since low-income working families often spend their tax credits on necessities, the federal EITC also helps boost Maine’s economy during slowdowns like the recent recession and ongoing slow recovery.

Maine is one of 26 states that has its own state version of the EITC, which qualifying taxpayers can claim against state income taxes. These state EITCs are cost-effective, easy to administer, and easy for taxpayers to calculate. Where state EITCs are refundable, like the federal EITC, they provide all of the same proven benefits of promoting work and reducing poverty as the federal credit.

Unfortunately, Maine’s version of the credit is much too small to be effective and is not refundable (the value of the credit cannot exceed a family’s tax liability). Only 20,000 Maine families received an average state credit of approximately $55 in 2013. To reduce poverty and make work pay for Maine’s low-income families, especially those with children, state policymakers should increase the size of Maine’s EITC and make it refundable.

The EITC reduces poverty

Maine has approximately 120,000 working families with at least one child under age 18. Of those, approximately 40,000—1 in 3—are poor or “near poor”, meaning they earn an income that leaves them below 200% of the poverty line.[1] 10,000 of these working families fall below the federal poverty level.

The EITC reduces poverty directly by increasing after-tax income for these working poor families.

Across the nation in 2013, 27 million families claimed the EITC on their federal income tax forms. The total amount claimed was $65 billion, and the average credit was $2,407.[2] In 2013, the federal EITC lifted 6.2 million people out of poverty, including 3.2 million children.[3]

In Maine, approximately 102,000 low- and moderate-income working families benefited from the federal EITC, receiving a total of $207 million in credits.[4] On average, the federal EITC lifted approximately 17,000 Mainers out of poverty each year from 2009 to 2013.[5]

The EITC rewards work

The EITC is only available to families and individuals who work and the value of the credit increases with each dollar earned until it reaches its maximum value. By design, the EITC promotes work and encourages families receiving public assistance to find jobs and increase their hours.[6]

The EITC increases lifetime earnings and retirement security

Recent research quantifies the life-long positive impact that the EITC has on children growing up in poverty. For each $3,000 a year in added income that children in a poor family receive before age 6, their working hours rise by 135 hours a year between ages 25 and 37, and their annual earnings rise by 17%.[7] In addition to improving living standards during their working years, these additional hours and earnings also translate into more savings for retirement and larger social security retirement benefits.

State EITCs are inexpensive and easy to administer

Like the other 25 states with their own EITCs, Maine’s is inexpensive to administer and easy for taxpayers and tax collectors to calculate. Maine’s credit is equal to 5% of the federal credit. To calculate their credit, Maine taxpayers simply enter the value of their federal EITC and multiply it by 0.05. This calculation uses just one line on the state income tax return.

How Maine’s EITC works

When Maine working families file their federal taxes, they fill out a worksheet to determine if they qualify for a federal EITC and calculate its value. Only low-income working families can qualify, and most of the families who qualify for a credit have children.

Maine’s EITC piggybacks on the federal EITC. Working families claiming the federal EITC simply calculate 5% of the value of their federal EITC and use it to offset some or all of their Maine income tax. Since Maine’s EITC is not refundable, a family that owes no state income tax gets no benefit from Maine’s EITC. Similarly, if the value of their state credit exceeds their tax liability (after all other deductions, exemptions, and credits), they lose the difference.

As a result, many working Mainers, particularly those in the lowest income brackets, receive a state credit worth much less than 5% of their federal credit. In fact, more than 80% of Maine families who qualify for the federal credit cannot claim the state credit, and none of Maine’s poorest working families—those with incomes below $24,000 per year—benefit from the state credit as currently structured.

For example, 102,000 Maine taxpayers claimed $207 million in federal earned income tax credits in 2013. If Maine’s state EITC were refundable, the total benefit for those low- and moderate-income working families under the state EITC would have equaled $10.4 million (5% of $207 million). But since Maine’s EITC is not refundable, the actual total value of the state EITC was only $1.1 million, or about 0.5% of the federal credit. Of the 102,000 Maine taxpayers who claimed the federal credit, only 20,000 were able to claim any state credit at all.

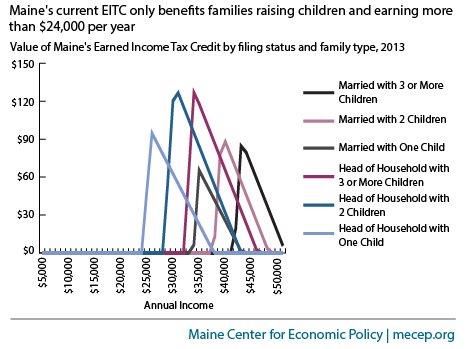

Figure 1

Since Maine’s credit is not refundable, it provides no benefits to low-income households with annual incomes less than $24,000 (see Figure 1). Even above that income level, only households with children are eligible to claim the credit. Since the EITC phases out at less than $15,000 in annual income for single childless workers and $20,000 for married couples without children, the only families in Maine currently eligible to claim Maine’s EITC are those who have children and earn more than $24,000 per year.

Increase Maine’s EITC and make it refundable to reduce poverty and make work pay

Maine is one of only four states where the state EITC is not refundable, and Maine’s EITC is one of the smallest in the nation[8]—much too small to be effective. In 2013, approximately 20,000 Maine families claimed a total of $1.1 million in credits, for an average credit of approximately $55.[9]

Policymakers should make the state EITC refundable and increase its value to 20% of the federal credit. These steps would move Maine closer to the middle of the pack among states that have their own EITCs.

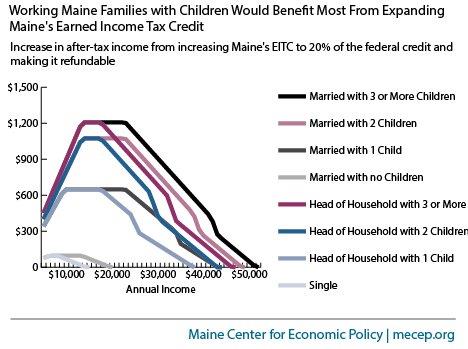

More importantly, it would increase annual after-tax income for 102,000 Mainers by $38.8 million, or an average of $384. The vast majority of the benefits would flow to working families with children and annual incomes below $40,000. The total fiscal cost to the state would be approximately $40 million per year.

These changes to the state’s EITC would be one of the most efficient and cost-effective ways to reward work and reduce poverty among working Maine families.

Working families with children would benefit from fixing Maine’s EITC

The vast majority of the benefits from increasing Maine’s EITC to 20% of the federal credit and making it refundable would accrue to low-income families with children who earn less than $40,000 per year (see Figure 2). For example:

- After-tax income for a married couple raising two kids and earning a combined annual income of $25,000 per year would rise by nearly $1,000. That same family receives zero benefit from Maine’s current EITC, because it is not refundable.

- A single working parent raising one child and earning $20,000 per year—$10 per hour, would receive a refundable credit of $570. That same worker currently receives zero benefit from Maine’s non-refundable EITC.

- A married couple raising three kids and earning a combined annual income of $45,000 can claim a credit up to $69 under Maine’s current EITC. Increasing the state EITC to 20% and making it refundable, would quadruple that family’s credit to $276.

- A single working parent raising two children and earning $30,000 per year—$15 per hour—would see their credit of $120 increase to $548.

Figure 2

A small number of childless workers with very low incomes, who currently receive zero benefit from Maine’s non-refundable EITC, would now be eligible for a very modest maximum refundable credit of about $98 per year. The benefit would phase out at $15,000 for childless single adults and $20,000 for childless married couples. For example:

- A childless adult earning $7,000 per year at a seasonal minimum wage job would be eligible for a credit of about $98. The credit would gradually phase out as their income increased to $15,000, at which point it would equal zero.

- A childless married couple with one partner working a full-time, year-round, minimum wage job, and one disabled partner would also be eligible for a modest benefit of $98. The credit would gradually phase out as their income increased to $20,000, at which point it would equal zero.

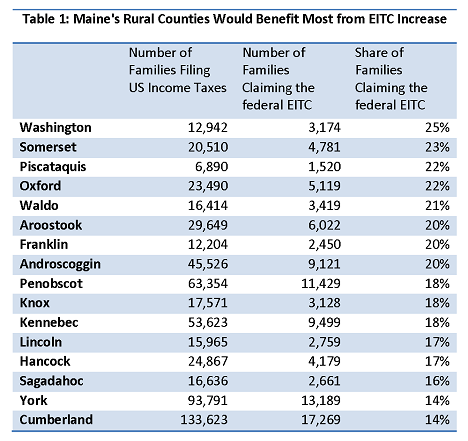

Rural areas would benefit most

Rural areas of the state have the lowest-paying jobs and the highest poverty rates, so increasing the state’s EITC and making it refundable would have a disproportionately large positive impact in these areas of the state. According to federal tax statistics, as shown in Table 1, Maine’s poorest and most rural counties have the largest concentrations of working families claiming the federal EITC. By making the state’s EITC refundable, these families would realize substantial increases in their after-tax income.

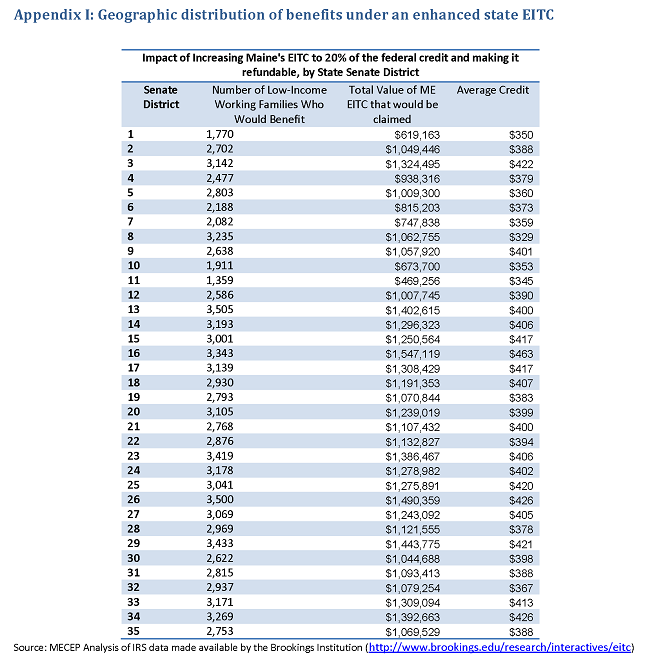

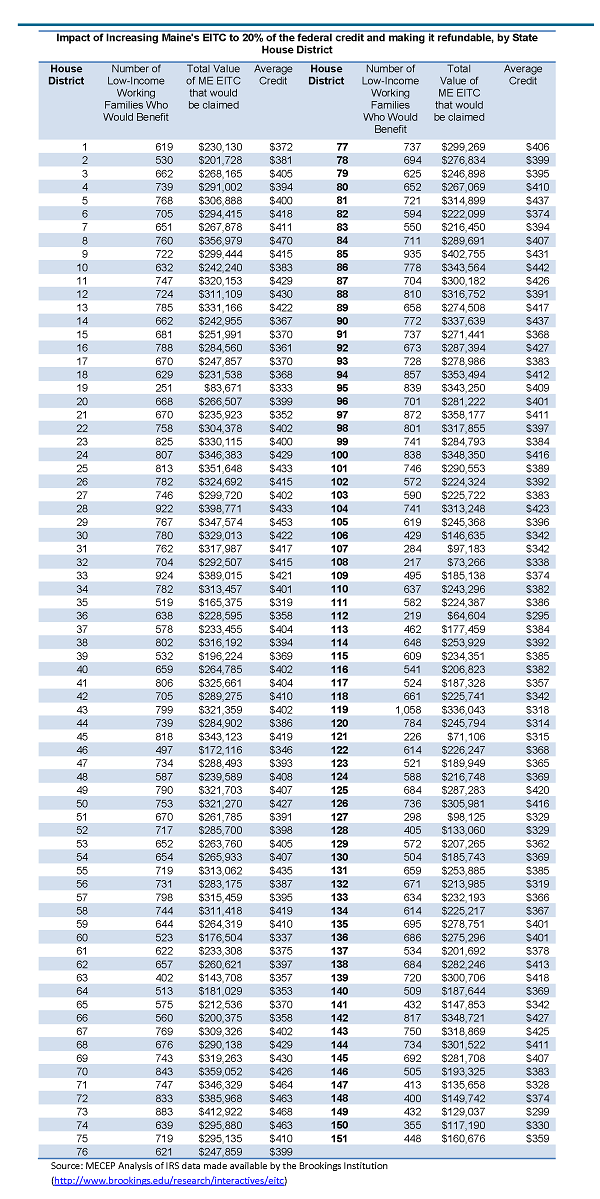

The appendix shows the projected tax refund by Maine Senate and House districts of increasing Maine’s EITC to 20% of the federal credit and making it refundable.

About MECEP

The Maine Center for Economic Policy provides citizens, policy-makers, advocates, and media with credible and rigorous economic analysis that advances economic justice and prosperity for all Maine people. MECEP is an independent, nonpartisan organization founded in 1994.

About the Author

Joel Johnson is MECEP’s economist. He has a master’s degree in resource economics and policy from the University of Maine, where he specialized in econometric and statistical analysis. Previously he served as an economist at the Maine State Planning Office. From 2013 to 2015, Joel served on the state’s Consensus Economic Forecasting Commission.

Acknowledgements

This brief is published with the support of the Working Poor Families Project, the Grantmaker’s Income Security Task Force, and the Elmina B. Sewell Foundation.

Appendix I: Geographic distribution of benefits under an enhanced state EITC

[1] Working Poor Families Project: Analysis of 2013 American Community Survey.

[2] Data from IRS. Available at: http://www.eitc.irs.gov/EITC-Central/eitcstats

[3] Center on Budget and Policy Priorities, “Policy Basics: The Earned Income Tax Credit”, January 31st, 2014. Available at: http://www.cbpp.org/cms/?fa=view&id=2505.

[4] Data from IRS. Available at: http://www.eitc.irs.gov/EITC-Central/eitcstats.

[5] Center on Budget and Policy Priorities analysis provided to MECEP on November 13, 2014.

[6] This report by the Center on Budget and Policy Priorities summarizes the research: http://www.cbpp.org/cms/index.cfm?fa=view&id=3793

[7]This report by the Center on Budget and Policy Priorities summarizes the research: http://apps.cbpp.org/3-5-14tax/?state=ME

[8] See table 1 of this report from the Center on Budget and Policy Priorities: http://www.cbpp.org/cms/index.cfm?fa=view&id=4084

[9] Maine Revenue Services, Office of Tax Policy Research.