Shoring up state funding for schools by cleaning up Maine’s tax code will promote opportunity for all Maine children

MECEP finds that a three percent tax on income above $200,000 dedicated to K-12 education will increase state funding for schools, promote tax fairness, help promote greater opportunity for low-income students, and level the playing field between property-poor and property-rich towns. It will have a positive impact for students, businesses, and Maine families, strengthening Maine’s economy.

![]() PDF of the full report, Moving Maine Students to the Head of the Class

PDF of the full report, Moving Maine Students to the Head of the Class

![]() PDF of the executive summary of the report, Moving Maine Students to the Head of the Class

PDF of the executive summary of the report, Moving Maine Students to the Head of the Class

This November, Maine voters will consider a ballot initiative (Question 2) that rolls back recent tax breaks for the wealthy and dedicates this revenue toward additional state level resources for schools. The Maine Center for Economic Policy (MECEP) examined the context for this initiative, its potential to promote tax fairness, and its capacity to improve educational outcomes and workforce readiness of Maine students.

MECEP finds that a three percent tax on income above $200,000 dedicated to K-12 education will increase state funding for schools, promote tax fairness, help promote greater opportunity for low-income students, and level the playing field between property-poor and property-rich towns. It will have a positive impact for students, businesses, and Maine families, strengthening Maine’s economy.

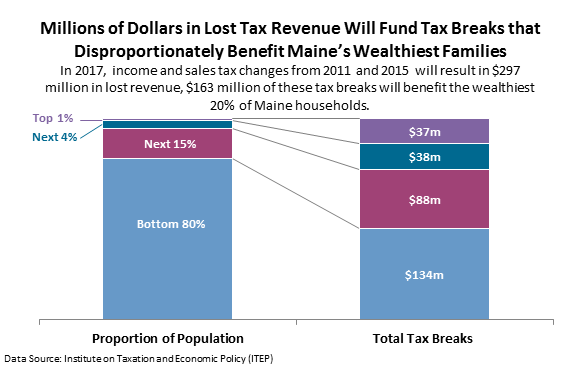

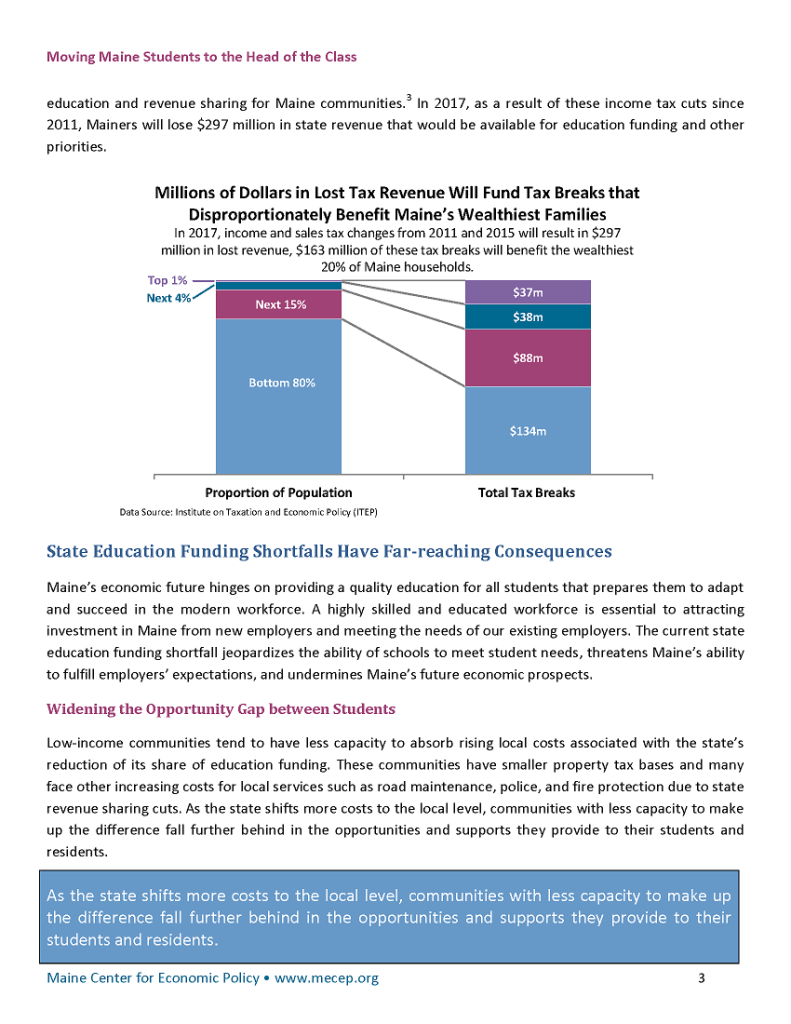

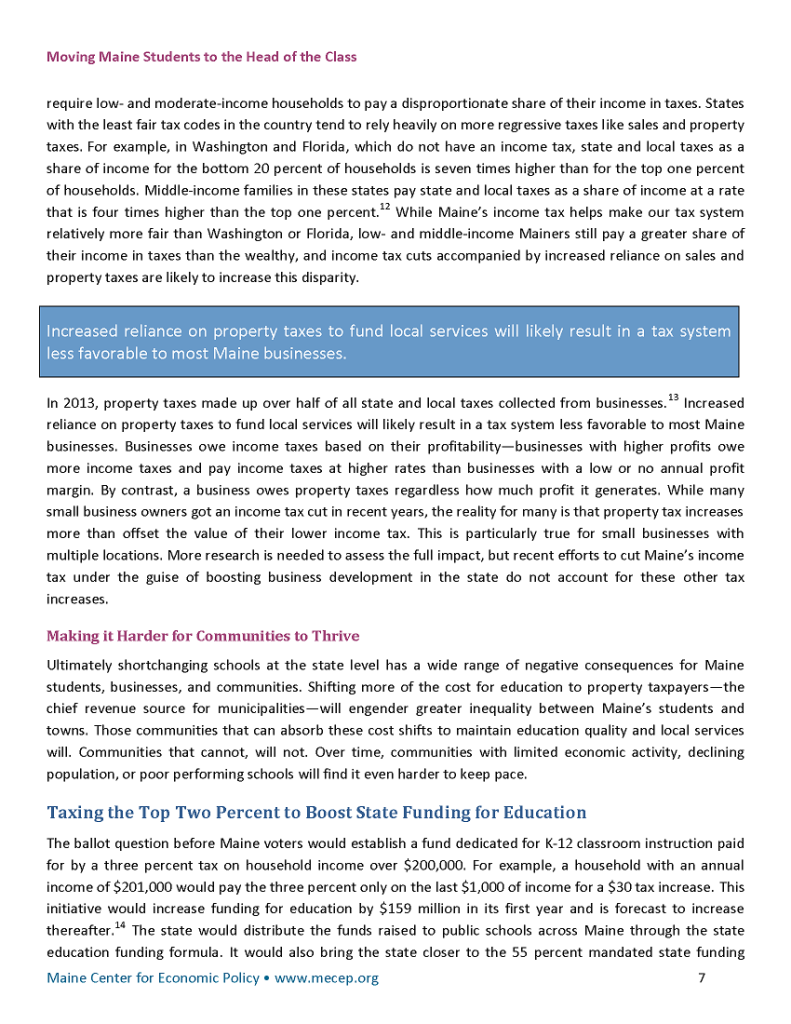

Tax Giveaways to the Wealthy Are Largely to Blame

Tens of millions of dollars in recent tax breaks compromise state capacity to invest in education. As a result of income tax cuts since 2011 that largely benefit wealthy households, Mainers will lose $297 million in state revenue in 2017 that would have been available for education funding. As the state’s contribution to education has decreased, local costs have increased—an average of $180 million a year. Shortchanging schools at the state level has a wide range of negative consequences for Maine students, businesses, and communities including: widening of the opportunity gap between students in high- and low-income communities; putting education quality at risk; hurting employers who struggle to find workers with skills their businesses need; compromising the fairness of Maine’s tax system; and making it harder for communities to thrive.

Key Findings

The ballot question before Maine voters would establish a fund for K-12 classroom instruction paid for by a three percent tax on household income over $200,000. For example, a household with an annual income of $201,000 would pay the three percent only on the last $1,000 of income for a $30 tax increase. This initiative would increase funding for education by $159 million in its first year and is forecast to increase thereafter. The funds raised would be distributed through the state’s education funding formula to public schools across Maine. It would also bring the state closer to the 55 percent mandated state funding share, offer property tax relief to communities across the state, and help to level the playing field between the wealthy and everyone else.

Over $150 Million Each Year to Improve Student Learning

Additional dollars from this initiative will go directly to support education. The initiative requires lawmakers to first fund schools using available resources through the general fund; then the Department of Education will allocate the revenues raised through the initiative according to the current school funding formula adding those dollars to the appropriation made by the legislature. This means the expected property tax rate that towns must raise to provide a basic education will go down, freeing up town revenue to invest more in education.

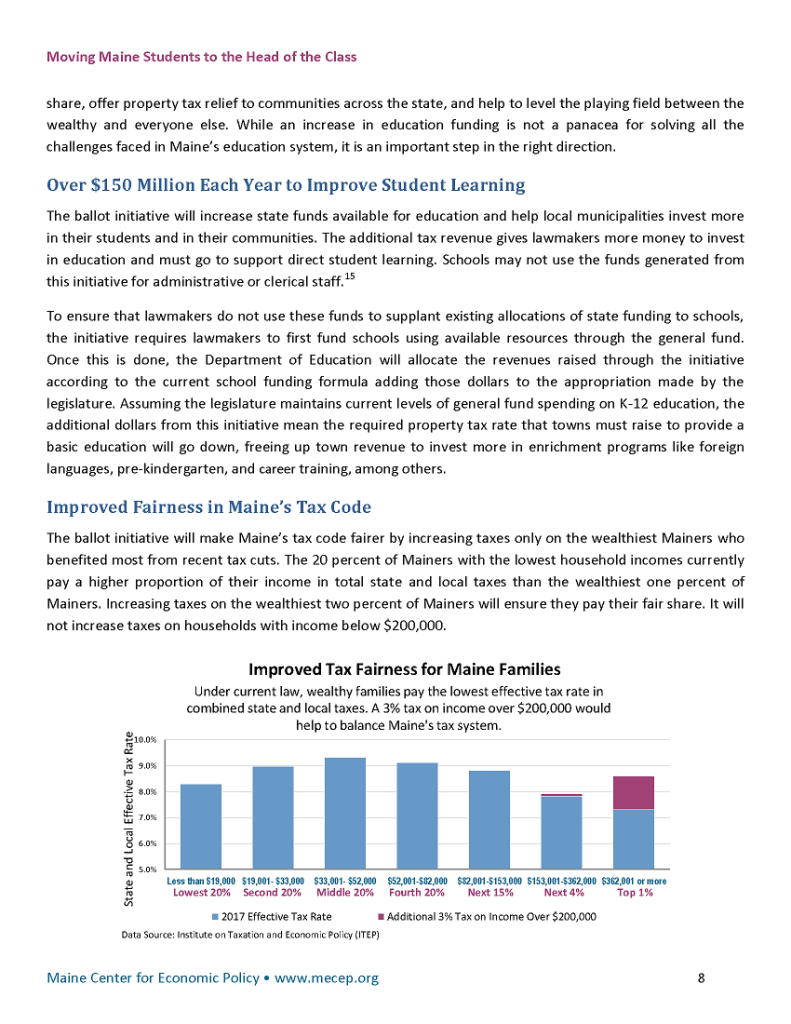

Improved Fairness and Transparency in Maine’s Tax Code

The 20 percent of Mainers with the lowest household incomes currently pay a higher proportion of their income in total state taxes than the wealthiest one percent of Mainers. The ballot initiative will make Maine’s tax code fairer by increasing taxes only on the wealthiest Mainers.

Greater Potential to Meet the Needs of All Maine Students

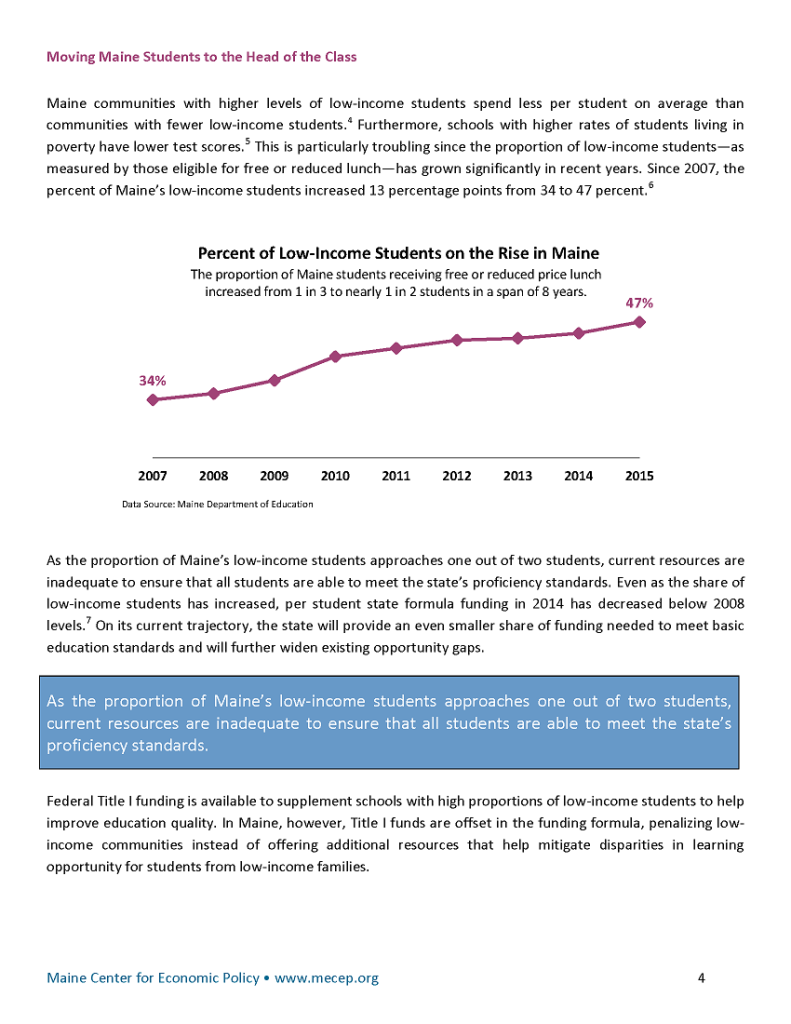

Maine communities with higher levels of low-income students spend less per student on average than communities with fewer low-income students, and schools with higher rates of students living in poverty have lower test scores. As the proportion of Maine’s low-income students approaches one out of two students, increased state funding for their schools will enable low-income towns to invest in additional learning resources for their students.

Improved Equality among Maine’s Regions

As Maine employers struggle to attract and retain skilled workers, high school seniors face a new economic reality—they need more skills than previous generations did to gain entry into the workforce. Demand for skilled workers with post-secondary education—defined to include anything from industrial skill certification to a graduate degree—is on the rise. The economic value of a strong education system is greatest when all communities in Maine benefit from the improvements it brings to the workforce and business environment. Increasing state funding will increase capacity for all Maine communities to afford a high quality K-12 education that prepares students to succeed in the classroom and the workforce. It will build a stronger economy throughout Maine.