Among the many provisions included in the American Rescue Plan passed by Congress in 2021 was a program to increase the affordability of health insurance purchased through the individual market at healthcare.gov. The program reduces monthly premiums by providing subsidies for everyone enrolled in the individual market, including people whose higher incomes had previously made them ineligible for assistance. However, the enhanced subsidies are only authorized through the end of 2022, and if Congress does not act soon, health insurance will become more expensive for all 66,000 Mainers currently using these subsidies, and up to 9,000 of those people could be forced to give up their insurance entirely.

Under the Affordable Care Act, Americans who are unable to get an affordable health care plan through their employer are able to purchase subsidized insurance through a marketplace. The final monthly premium paid for subsidized insurance depends on the total income of a family in relation to the sticker price of a mid-level plan (known as the benchmark plan)1 and is based on a sliding scale.

Example for an individual

For a 40-year-old non-smoker in Androscoggin County, the monthly premium for a benchmark plan is $436 per month, or $5,234 per year. Assuming this individual earned $36,620, their income would be 200 percent of the federal poverty level. At this level, their premiums are capped at 2 percent of their household income, or $732 per year. This individual would receive an annual subsidy of $4,502.

If the subsidies are allowed to expire, the premium cap for someone at 200 percent of the federal poverty level increases from 2 percent to 6.52 percent of household income. The premiums would now be capped at $2,388 per year — an increase of $1,656 a year.

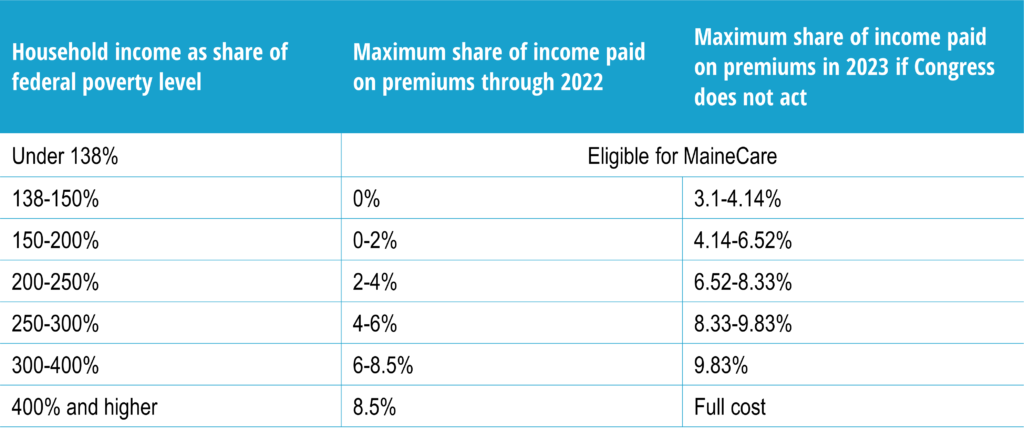

Full schedule of current premium caps and those which would be introduced if the enhanced subsidies expire:

The actual impact of the expiring subsidies on Mainers will vary significantly depending on their family composition, age, and county of residence. In general, older Mainers and people in the more rural parts of the state face higher benchmark premiums.

Example for a family

For a family of four in Cumberland County — two adults in their thirties and two children — the benchmark premium is $14,718 per year. Their household income is $83,000 a year, putting them at 300 percent of the federal poverty level. Currently, their premiums are capped at 6 percent of their household income, or $4,980 per year. This means they currently receive a subsidy of $9,738 a year.

If enhanced subsidies are allowed to expire, their premium cap would increase to 9.83 percent of their household income, or $8,159 per year — an increase of $3,179 a year.

Example for an older couple

For an older couple in Aroostook County — two adults in their sixties — the benchmark premium is $27,620. Their household income is $75,000, putting them at 410 percent of the federal poverty level. Currently, their premiums are capped at 8.5% of their income, or $6,375 per year. This means they receive a subsidy of $21,245.

If enhanced subsidies are allowed to expire, this couple would exceed the income thresholds under the ACA and receive no subsidy at all, resulting in an increase of $21,245 a year.

Severe impacts

A recent report from the Robert Wood Johnson Foundation and the Urban Institute estimates that 9,000 fewer Mainers will have health insurance if Congress allows the subsidies to expire. Tens of thousands more people will face thousands of dollars in increased costs just to keep their current insurance.

Congress has the opportunity to avoid this harmful cost increase for Mainers at a time when household budgets are being squeezed especially hard. To keep health care affordable, the Maine Center for Economic Policy urges Maine’s Congressional delegation to prioritize making the enhanced premium subsidies permanent.

Notes:

[1] A benchmark plan for the purposes of calculating premium subsidies is defined as the silver-tier plan with the second least expensive monthly premiums.