Co-authored by James Myall, Arthur Phillips & Maura Pillsbury

In the first half of 2025, MECEP presented 110 pieces of testimony before the Maine Legislature that affect the lives of everyday Mainers. Below are highlights from the legislative session related to economic justice and tax fairness.

Budgets

The legislature passed two major appropriations bills this year, LD 609 (in March) and LD 210 (in June). The budget package passed by the Legislature invests in key state priorities, especially within the MaineCare program, and rejects many of the most harmful cuts to assistance programs proposed by Governor Mills. It includes modest steps toward a more progressive tax code.

Still, lawmakers stopped short of embracing the bold, ongoing revenue solutions needed to fully support Maine people, particularly as uncertainty looms around future federal funding.

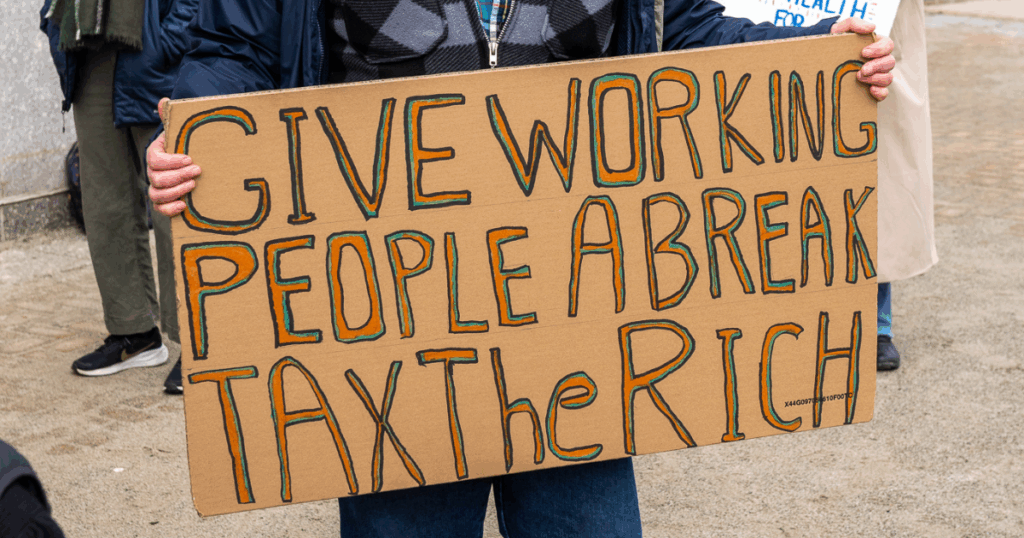

Tax Fairness

Maine can prevent damaging budget cuts by ensuring the wealthiest residents and corporations contribute their fair share in taxes. The legislature passed multiple bills this session aimed at increasing taxes on higher earners. Of those, only a handful of more limited measures were signed by the Governor and became law.

The legislature largely supported other significant changes to increase taxes on the wealthy and corporations, but they were carried over to next session due to veto threats from the Governor.

- LD 229 (passed in the House and Senate; carried over) would create two new top brackets of 7.75% and 8.95% on income over $144,500 and $500,000 respectively for single filers, and over $289,000 and $1 million for joint filers. The bill would also decrease the bottom tax rate on income under $27,450 single/$54,900 joint filers from 5.8% to 5.5%.

- LD 1082 (signed into law as part of the budget) increases the Real Estate Transfer Tax on homes sold for over $1 million. The tax on the portion of sale price above $1 million was increased from $2.20 per $500 to $6 per $500, with the revenue dedicated to funding affordable housing. The bill also exempts first-time home buyers from the tax if they receive financial assistance from MaineHousing.

- LD 1089 (passed in the Senate but failed to pass in the House; carried over) would create a 2% surcharge on income over $1 million for single filers, or $2 million for those married filing jointly, with the revenue dedicated toward prek-12 education.

- LD 1294 (signed into law as part of the budget) doubles the Dependent Exemption Tax Credit (Maine’s version of the child tax credit) from $300 to $600 for children under 6 years old, a crucial time in child development. The proposal pays for itself by lowering the income eligibility threshold for qualifying for the full benefit from $200k for single filers/$400k for married joint filers to $100k single/$150k married.

- LD 1879 (passed in the House and Senate; carried over) would increase the top corporate income tax rate for corporations making over $3.5 million per year by just over 1%, from 8.93% to 10%. Approximately $30 million of the funding raised by the bill each year would go to programs to support the agriculture industry, with another $20 million going to the general fund.

- Pension deduction phaseout (signed into law as part of the budget) phases out the tax deduction on pensions for higher earners. The first $48,216 of pension income is exempt from taxation in Maine (equal to the current maximum social security benefit at full retirement age). Previously, Maine tax filers could take this deduction regardless of their total income, meaning even high earners could take the deduction. Now, the benefit will phase out gradually for single filers with adjusted gross income over $100,000 and those married filing jointly over $200,000.

Worker rights

Maine made important progress on worker rights, advancing protections for hourly, salaried, and farmworkers alike. Lawmakers took steps to expand fair pay, improve workplace transparency, and strengthen labor standards, even as some efforts stalled due to funding constraints or executive vetoes. While several new rights were secured — and a number of attempts to weaken or undermine Maine’s Paid Family and Medical Leave program were rejected by legislators — others remain unfinished business, highlighting both momentum and ongoing challenges in the fight for economic dignity on the job.

- LD 54 (remains on appropriations table) would require employers to display pay ranges on job advertisements. It was preliminarily approved by the legislature, but the appropriations committee failed to allocate the funding necessary to enforce the law.

- LD 588 (vetoed), which would protect farmworkers from retaliation when they speak up about unsafe working conditions or unfair treatment, was vetoed by the Governor. This kind of concerted activity is a right held by nearly all other private sector workers in this country and is just one of many rights farmworkers are still denied. This protection is especially vital in the current atmosphere of fear in which many migrant farmworkers labor.

- LD 589 (signed into law) extends the state’s minimum wage to include farmworkers, and was signed into law by Governor Mills, a move that acknowledges farmworkers deserve the same economic dignity as other workers. This victory is the result of years of hard work by legislators, advocates, farmers, and farmworkers, and it is a moment worth celebrating.

- LD 598 (became law without the Governor’s signature) provides a new right to “reporting pay” for Mainers who are called into work but sent home before they can actually work a shift. Any hourly worker who reports to work after being called in by their employer will be entitled to a minimum of two hours’ pay, even if they are sent home before that.

- LD 599 (remains on appropriations table) would put proposed federal overtime rules into state law and ensure around 26,000 low-pay salaried workers cannot be made to work unpaid overtime. It was approved by the legislature but didn’t go into law because the appropriations committee didn’t approve additional funding for state worker overtime under the bill.

- LD 799 (remains on appropriations table) would require public reporting of the gender wage gap among the employees of large corporations in Maine. It received preliminary approval from the legislature, but the Appropriations Committee did not allocate funding for the Department of Labor to publish and analyze the responses.

Consumer protections and corporate accountability

Maine lawmakers took steps to improve fairness and transparency in the marketplace, with a focus on protecting consumers and ensuring public dollars are used responsibly. These initiatives reflect growing concern about corporate practices that hurt Maine families and the need for better oversight of how economic power is exercised.

- LD 414 (became law without the Governor’s signature) codifies federal protections against deceptive pricing practices. This will ensure that regardless of actions at the federal level, Mainers will benefit from transparent pricing in short-term rentals and events.

- LD 1107 (remains on appropriations table) proposed a study of how the State can centralize data on business tax breaks, which is inconsistently tracked across multiple state agencies, leading to potential duplication and waste of Maine taxpayer dollars.

- LD 1894 (remains on appropriations table) proposed a study on grocery pricing fairness to examine factors that lead to the creation of food deserts, including the impact of anti-trust laws and grocery supply chain manipulation on competition and consolidation in the grocery retail industry.

Business tax giveaways

Each year the state of Maine gives away millions of public dollars in subsidies to businesses in the form of tax breaks. Often these tax breaks are not proven to deliver on the outcomes they promise, and in some cases are proven to be ineffective. Several bad business tax giveaways were proposed and passed this session that will have significant impacts on the state’s ability to raise revenue in the future. These included:

- LD 125 (signed into law) increases the available amount for the Seed Capital Tax Credit from $5 million to $10 million per year.

- LD 1217 (signed into law) reauthorizes the New Markets Capital Investment Program, at a cost of $97.5 million over 10 years beginning in 2027.

- LD 1951 (signed into law) extends and expands the existing Food Processing and Manufacturing Facility Expansion Tax Credit through 2027, allowing additional businesses to claim the credit at a cost of up to $4 million.

Health care

Lawmakers made progress in protecting Mainers from the financial burden of medical care, particularly for low-income families. Meanwhile, broader efforts to explore universal coverage or expand access for certain immigrant communities stalled—highlighting both important gains and ongoing gaps in Maine’s health care system.

- LD 558 (signed into law) stops medical debt from showing up in Mainers’ credit reports, meaning that a medical catastrophe will no longer impact their ability to rent a home or buy a car.

- LD 842 (withdrawn at sponsor request) would expand access to health care for some low-income immigrants who are otherwise ineligible to receive MaineCare.

- LDs 1070, 1269, and 1883 (rejected by respective legislative committees) would study pathways to universal public health care access in Maine.

- LD 1937 (signed into law) expands and streamlines eligibility for Free Care in Maine’s hospitals. Mainers whose family income is below 200% of the federal poverty level ($53,300 for a family of 3 in 2025) will be entitled to medically necessary care for free at Maine’s nonprofit hospitals. The bill also limits repayment plans for hospital debt to no more than 4% of a household’s monthly income if their income is below 400% of the federal poverty level.

Direct care

The Mills administration failed to implement scheduled cost-of-living adjustment for direct care services and later proposed a budget that provided no direct care COLAs for the two-year biennium. Lawmakers pushed back against those cuts, partially restoring COLAs in both budgets (LDs 609 and 210).

New initiatives were also proposed to improve wages, training, and data tracking, laying groundwork for a more sustainable, effective system that better supports both care workers and the people who rely on them.

- The legislature rejected some of the proposed budget cuts, appropriating approximately $38 million in state funds towards MaineCare services COLAs. The legislature also rejected proposed changes to MaineCare services rate review process that would have undermined the system that has been established in recent years.

- LD 977 (signed into law; funded by appropriations committee) will task the Maine Health Data Organization (MHDO) with developing a plan to annually measure the gap between direct care for which Maine people are approved and the care they receive. MHDO will submit a report to the HHS Committee by January 2026 outlining their findings and the estimated cost of implementing an annual care gap analysis.

- LD 1932 (carried over with forthcoming legislative hearing in the Health and Human Services Committee) would make a range of improvements to the direct care system, including increasing labor reimbursement for essential care and support services from 125% to 140% of the state minimum wage. The bill would also make improvements to essential support worker credentialling and training and the adoption of innovative technologies.

Child care

Child care was a major flashpoint this session, as providers, parents, and advocates fought back against deep proposed cuts and pushed for long-term solutions. Governor Mills proposed rolling back the child care wage supplement program which would have amounted to an average of $4,000 pay cut for each child care worker over two years. The governor also proposed slashing state funding for Head Start and eliminating a program to help early childhood educators afford the cost of care for their own children.

In March, hundreds of child care providers closed their doors in protest and flooded the State House to decry the proposed cuts. While the Legislature ultimately restored most of the funding and set the stage for future progress, work remains to build a child care system that truly supports those who provide and depend on it.

- LD 1736 (signed into law) empowers the Office of Child and Family Services to enter into contracts directly with child care providers to ensure access to underserved groups, including but not limited to infants, children with disabilities, children in underserved areas, children experiencing housing instability, and more.

- LD 1859 (carried over) would create regional resources hubs to help parents, providers, and employers navigate child care and other family resources.

- LD 1955 (held by the Governor) would eliminate the waiting list for the child care affordability program and shored up funding for wage supplements, among other improvements. The AFA committee ultimately amended the bill to simply create, but not provide money for, a fund for the wage supplement program which was renamed the Salary Sustainability Program for Child Care Professionals.

Housing

Lawmakers took steps to address Maine’s housing challenges by both strengthening tenant protections and raising new revenue for affordable housing, reflecting a growing recognition that bold action is needed to make housing more stable and affordable across the state.

- LD 1082 (included in the second appropriations bill) increased the Real Estate Transfer Tax on homes sold for over $1 million. The tax on the portion of sale price above $1 million was increased from $2.20 per $500 to $6 per $500, with the revenue dedicated to funding affordable housing. The bill also exempts first-time home buyers from the tax if they receive financial assistance from MaineHousing.

- LD 1287 (signed into law) creates a new Housing Stability Support program that will provide up $300 a month towards rent for Mainers with low incomes, up to a maximum of $3,000 a year. This will continue, in a much-reduced form, some of the help currently provided by the Eviction Prevention Program. A bill to fully continue the EPP (LD 1522) was carried over.

- LD 1723 (signed into law) gives Mainers in manufactured housing communities new protections from excessive price increases for lot rent and other fees. This will require owners of mobile home communities to send notices to residents in advance of any rent or fee increase and gives tenants an opportunity for mediation if the fee increases outpace increases in general cost of living by more than 1% per year.

Immigrant rights

The legislature rejected a number of bills that would have harmed New Mainers and the state’s economy, including bills that would have restricted the ability of immigrants to receive support through General Assistance and other safety net programs.

- LD 1971 (passed by the Legislature; awaiting Governor action) would limit the ability of local law enforcement agencies to partner with federal immigration enforcement, but the Governor has not acted on this bill and will decide whether to veto or not before the next legislative session.

Tribal sovereignty

MECEP supports the Wabanaki Nations in their call to reform the 1980 Maine Indian Claims Settlement Act and the Maine Implementing Act, which restrict their inherent right to self-govern. When the Wabanaki Nations have the freedom and resources to thrive, it strengthens the wellbeing of everyone in Maine.

- LD 958 (vetoed) would remove the state’s ability to seize tribal land through the eminent domain process. MECEP supported this bipartisan bill as an important step to recognizing inherent tribal sovereignty over their own land. Other bills to address tribal sovereignty are expected to be introduced next year.