On Thursday, Congress enacted a new round of funding for the Payroll Protection Program, or PPP, which provides loans to help businesses cover payroll and other expenses during the pandemic.

PPP is a lifeline to small businesses in Maine, which play a large role in the state’s economy but are particularly vulnerable to economic shocks. However, flaws in the program’s design make it easier for larger corporations to obtain limited relief funds. Those flaws mean small businesses may be left behind, and Maine’s economy may be further dominated by large corporations when the coronavirus recession is over.

Subsequent rounds of relief must be tailored to the vulnerable small businesses that drive Maine’s economy, not the large corporations that are already better equipped to survive the crisis.

Small businesses are uniquely important to Maine’s economy – and uniquely vulnerable to COVID-19 crunch

Along with nearly every other governor in the country, Governor Janet Mills has ordered non-essential businesses to close or greatly reduce operations in an effort to limit the virus. Even before the order, though, many American workers, consumers, and business owners were limiting economic activity to protect themselves, their families, and their communities.

As a result, the entire economy is at a near-standstill. In the last month alone, nearly one in seven Maine workers have filed unemployment claims.

This contraction is especially hard on small businesses, which tend to have fewer resources to tide them over during hard times. A national survey by JP Morgan Chase found that half of their small business customers had less than 27 days’ cash on hand. One in four had less than 13 days’ worth of cash reserves.

Small businesses also make up a larger share of Maine’s economy than in other states. Almost 60 percent of Maine’s private-sector employees work for businesses with fewer than 500 employees, the sixth-highest rate among the states. As a result, Maine’s economy and workforce are more vulnerable to shocks in the small-business economy.

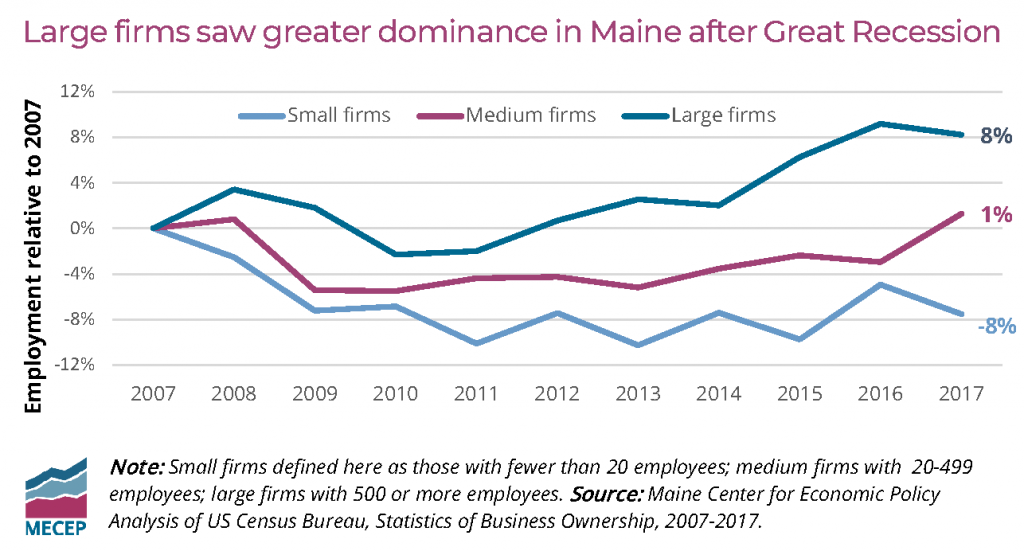

History shows that the harm to small businesses during a recession can fundamentally alter Maine’s economy. During the Great Recession of 2008, Maine’s smallest businesses suffered greater losses and were slower to recover than large businesses. As a result, Mainers became more reliant on large corporations — for employment as well as for goods and services.

Flaws in Payroll Protection Program leave some small businesses behind

Congress and the state policymakers have taken steps to provide some relief to some small business owners.

At the federal level, the US Small Business Administration is overseeing implementation of several loan programs provided through local banks, including PPP. The program is designed to help businesses maintain payroll and cover expenses for a limited period of time during the acute health and economic crisis.

Businesses can apply for a loan equal to 2.5 months of payroll costs, up to $10 million. Because the PPP is meant to help businesses maintain jobs, the loan will be forgiven for businesses who spend at least 75 percent of the total on payroll. According to US Senator Susan Collins, 16,699 Maine businesses received PPP loans totaling $2.24 billion through April 16. The Senator said those funds would cover payroll for 180,000 Maine workers, or more than one in four Maine workers.

There was so much demand for the first round of loans that the $350 billion originally appropriated by Congress was exhausted in just nine days. Congress injected another $300 billion into the program on Thursday.

The additional funding was necessary, but there remain underlying problems with the program that make PPP a blunt instrument for small-business relief.

During the first round of distribution, the “first-come, first-serve” approach to implementation meant that larger businesses with pre-existing relationships with banks and other financial institutions could easily edge our smaller businesses – even if those small firms are in more desperate need of assistance.

The program defines “small business” as any company with fewer than 500 employees and contains a loophole that allows large restaurant and hotel chains to apply for loans if individual branches fall under the 500-employee threshold. Several national restaurant chains have taken advantage of this, as well as at least 180 publicly-traded companies. The list of publicly-traded companies includes Carroll’s Restaurant Group, which owns more than 1,000 Burger King and Popeye’s franchises across the country (including several in Maine), and has 31,500 employees.

Congress did seek to address some of this disparity when they added new funds to the PPP, setting aside $60 billion to be lent out by smaller banks and credit unions, which are more likely to have the smallest businesses as their customers. Nonetheless, the ability of large food and hospitality chains to take advantage of the program persist and the majority of funds are just as poorly targeted as before.

Future funds must be better targeted to small firms that need relief the most

The current partial shutdown of the economy is indisputably necessary to protect public health against COVID-19. But lawmakers also need to ensure that businesses and workers can weather the storm well enough to reopen once the pandemic is under control.

Small businesses are especially vulnerable in this time and play a key role in Maine’s economy. State and federal lawmakers must continue to ensure that the COVID-19 downturn does not lead to further declines in the small business sector which will ultimately harm consumers and weaken our economy.

Demand for PPP loans far exceeded the program’s original funding, and expert observers believe additional funding will be necessary after the latest round is depleted. Subsequent funding should come with implementation provisions that ensure the financial support is going to the small businesses that need it most.