“To reduce poverty and make work pay for Maine’s low-income families, especially those with children, state policymakers should increase the size of Maine’s EITC and make it refundable”

Augusta, Maine (Monday, April 27, 2015) “To reduce poverty and make work pay for Maine’s low-income families, especially those with children, state policymakers should increase the size of Maine’s EITC and make it refundable,” the Maine Center for Economic Policy (MECEP) concludes in a new report, “Fix Maine’s EITC to Reward Work and Reduce Poverty,” released today. The Maine legislature’s Joint Standing Committee on Taxation will hold a hearing tomorrow (Tuesday, April 28) to consider several bills that would make changes to the state’s EITC. The hearing will begin at 1:00 p.m. in Room 127 in the State House.

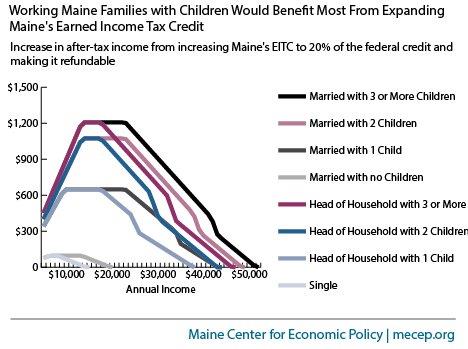

“Policymakers should make the state EITC refundable and increase its value to 20% of the federal credit,” the MECEP report recommends. Taking these steps “would increase annual after-tax income for 102,000 Mainers by $38.8 million, or an average of $384. The vast majority of the benefits would flow to working families with children and annual incomes below $40,000.”

Economist Joel Johnson authored the report which notes that in 2013, 27 million families nationally claimed $65 billion in earned income tax credits (EITC) and that the average credit was $2,407. The Center on Budget and Policy Priorities (CBPP) estimates that the federal EITC lifted 6.2 million Americans, including 3.2 million children, out of poverty in 2013. Internal Revenue Service data shows that approximately 102,000 low- and moderate-income Maine working families received a total of $207 million in EITC credits in 2013. CBPP estimates that the federal EITC enabled approximately 17,000 Mainers to escape poverty annually from 2009 to 2013.

“Maine’s poorest and most rural counties have the largest concentrations of working families claiming the federal EITC,” Johnson’s report found . “By making the state’s EITC refundable, these families would realize substantial increases in their after-tax income. These changes to the state’s EITC would be one of the most efficient and cost-effective ways to reward work and reduce poverty among working Maine families.”

A married couple with two children and a combined annual income of $25,000 currently receives no benefit from Maine’s EITC. If the legislature adopted MECEP’s recommended changes that same family’s after tax income would increase by nearly $1,000. A single Maine working parent with one child and earning $20,000 per year- $10 per hour -gets no benefit from the state’s current EITC. MECEP’s recommended changes would deliver a refundable state credit of $570 to such families.

For a PDF version of “Fix Maine’s EITC to Reward Work and Reduce Poverty,”click here.